Borang B 2018 Due Date

Skim persaraan swasta private retirement scheme 36.

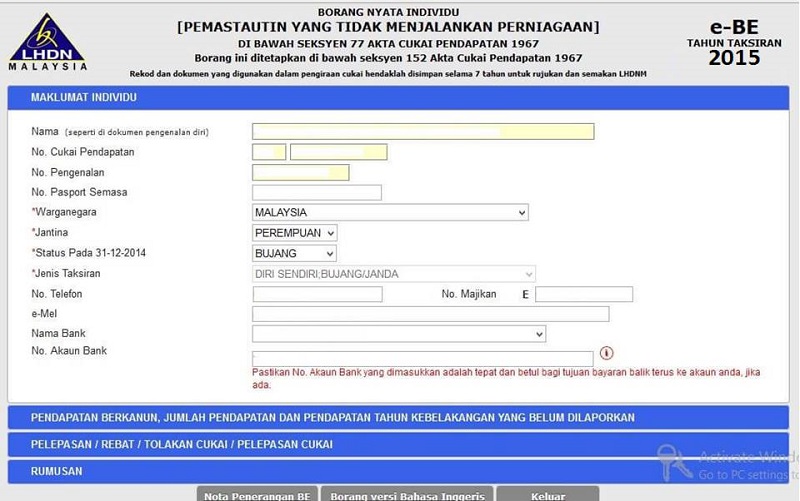

Borang b 2018 due date. A refer to the explanatory notes before filling up this form. The due date for submission of form be for year of assessment 2018 is 30 april 2019. B within 60 days from the due date a further increase in tax of 5 under subsection 103 4 of ita 1967 shall be imposed. Use form b if carries on business.

A refer to the explanatory notes before filling up this form. B failure to furnish form e on or before 31 march 2019 is an offence under paragraph 120 1 b of the income tax act 1967 ita 1967. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. Sila isikan pendapatan penggajian anda dalam borang b yang sama.

Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019. Grace period is given until 15 may 2018 for the e filing of form be form e be for year of assessment 2017. B within 60 days from the due date a further increase in tax of 5 under subsection 103 4 of ita 1967 shall be imposed. Selasa 24 april 2018 5 31pm.

A on or before the due date an increase in tax of 10 under subsection 103 3 of ita 1967 shall be imposed. Grace period is given until 15 may 2019 for the e filing of form be form e be for year of assessment 2018. Adakah saya perlu mengisi kedua dua borang b dan be. Yang mempunyai pendapatan daripada punca perniagaan pula diberikan tambahan masa sehingga 15 julai untuk mengemukakan borang b atau m tahun taksiran 2017 secara e filing.

A on or before the due date an increase in tax of 10 under subsection 103 3 of ita 1967 shall be imposed. Employers who have e data praisi need not complete and furnish c p 8d. Form type category due date for submission e 2019 employer 31 march 2020 be 2019 resident individual who does not carry on any business 30 april 2020 b 2019 resident individual who carries on business 30 june 2020 p 2019 partnership bt 2019 resident individual knowledge worker expert worker 30 april 2020 does not carry on any business. Cari kata kunci.

1 due date to furnish this form. A on or before the due date an increase in tax of 10 under subsection 103 3 of ita 1967 shall be imposed. A refer to the explanatory notes before filling up this form. The due date for submission of form be for year of assessment 2017 is 30 april 2018.

B within 60 days from the due date a further increase in tax of 5 under subsection 103 4 of ita 1967 shall be imposed. Bagaimanapun menurut kenyataan lhdn lanjutan tempoh itu tidak terpakai untuk kemukakan borang nyata cukai. Anda hanya perlu mengisi borang b sahaja jika anda mempunyai pendapatan perniagaan dan juga anda perlu mengembalikan borang b selewat lewatnya pada 30 jun.