Borang B For Income Tax

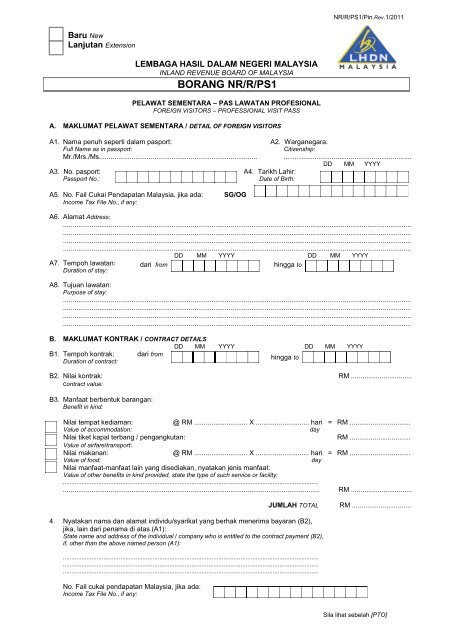

Pembayar cukai yang baru atau pertama kali melaporkan pendapatan menyamai melebihi rm 450 000 dimaklumkan bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac.

Borang b for income tax. Be form income assessed under section 4 b 4 f of the income tax act 1967 ita 1967 and be completed by individual residents who have income other than business. After clicking on e borang then you will be shown a list of income tax forms. Apa beza borang be dan borang b. Remember you file for 2018 income tax in 2019.

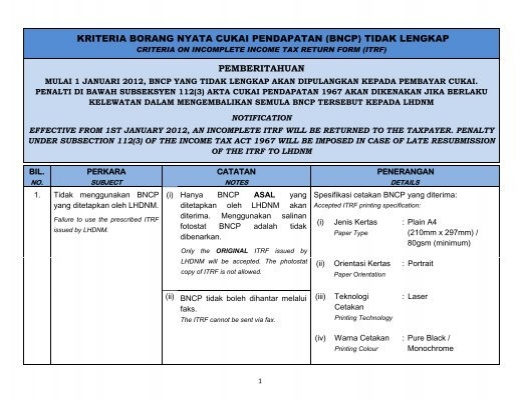

Borang be e be tiada punca pendapatan perniagaan. When you arrive at irb s official website look for ezhasil and click on it at the various options available on the ezhasil page choose the mytax option. E permohonan pindaan be adalah permohonan pindaan atas kesilapan atau khilaf bagi borang nyata cukai pendapatan yang telah dikemukakan secara e filing atau m filing dalam tempoh semakan pengesahan semakan semula pengesahan penerimaan borang yang telah dihantar secara e filing. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020.

If you are an individual with non business income choose income tax form be e be and choose the assessment year tahun taksiran 2018. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Especially with the income tax e filing system introduced this year with a new face lift how do we go about it. Pay your income tax.

Failure to do so will result in the irb taking legal action against the company s director. You can also pay your income tax via credit card. This will lead you to the main page of the the e filing system. If you have taxes due you can pay through various methods such as e banking collection agents and atm.

Sebenarnya borang be b 2019 akan dimuat naik pada 1 mac. Upon confirming your details and submitting you will need to pay additional tax owed or receive excess tax paid refunded. Go to e filing website. Borang be untuk.

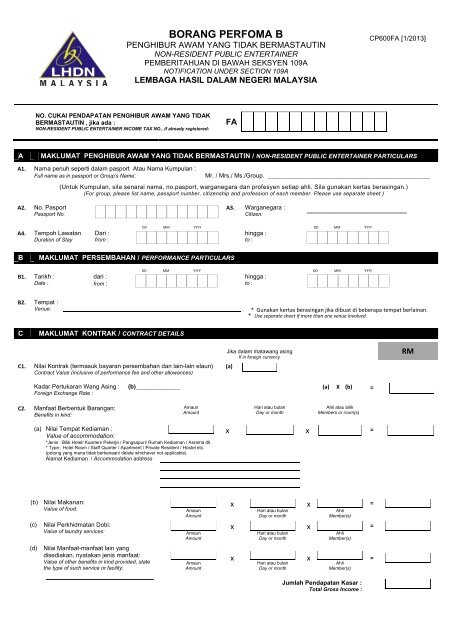

If you ve paid income tax in excess via monthly tax deductions the excess amount will be reimbursed to you via the bank account details you provided. Cukai pendapatan kesejahteraan cukai anda bermula di sini. Borang b bt e b e bt ada punca pendapatan perniagaan pekerja berpengetahuan atau berkepakaran there is a cause of business income knowledge or skill worker.