Borang E And Ea

How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967.

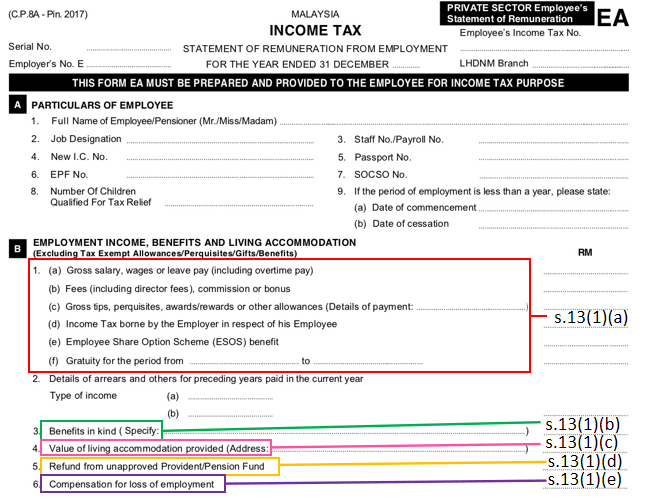

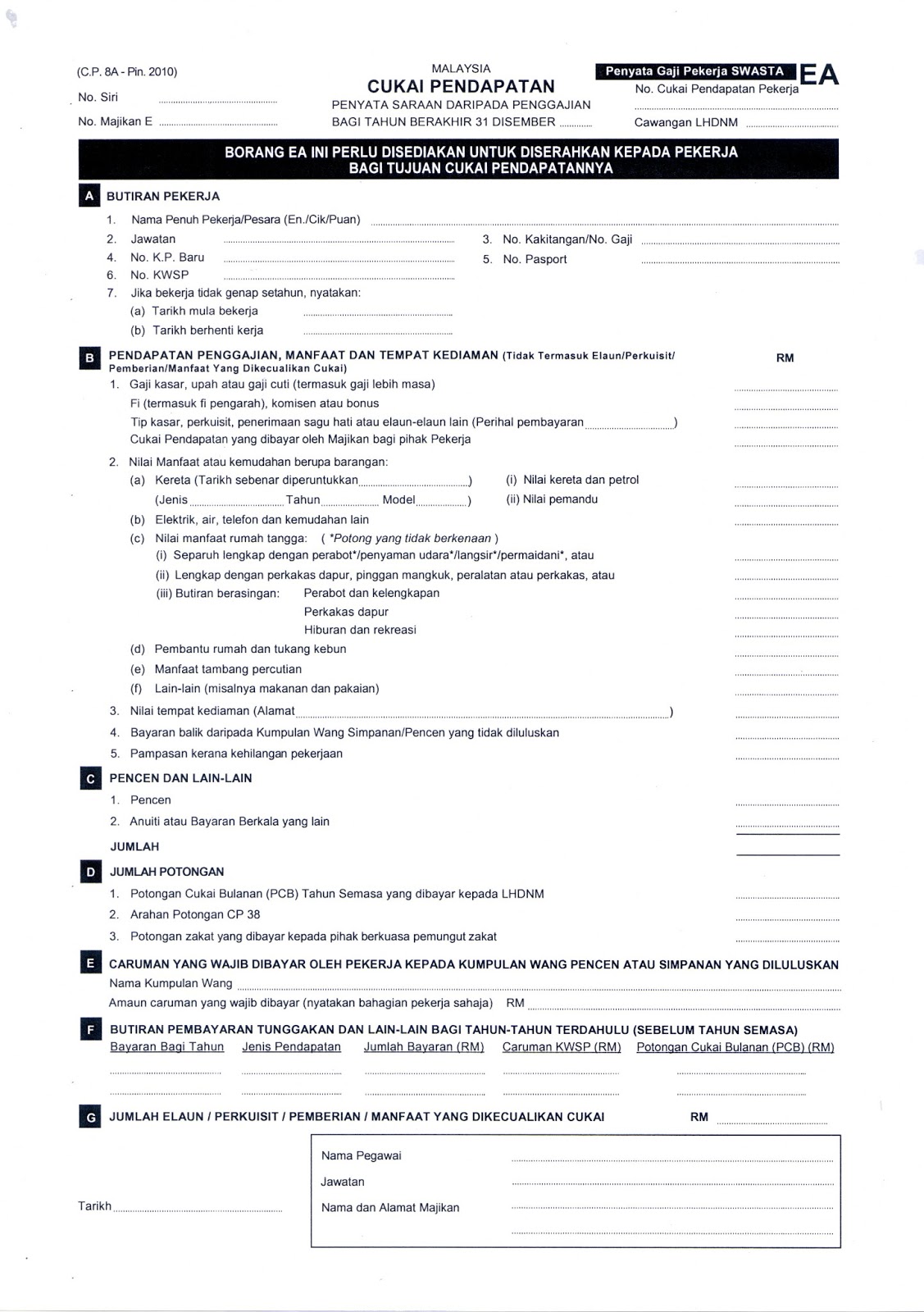

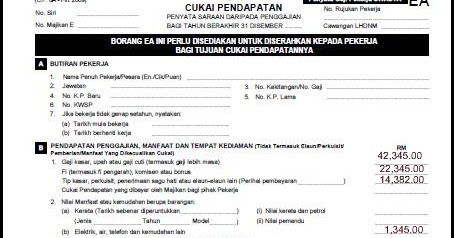

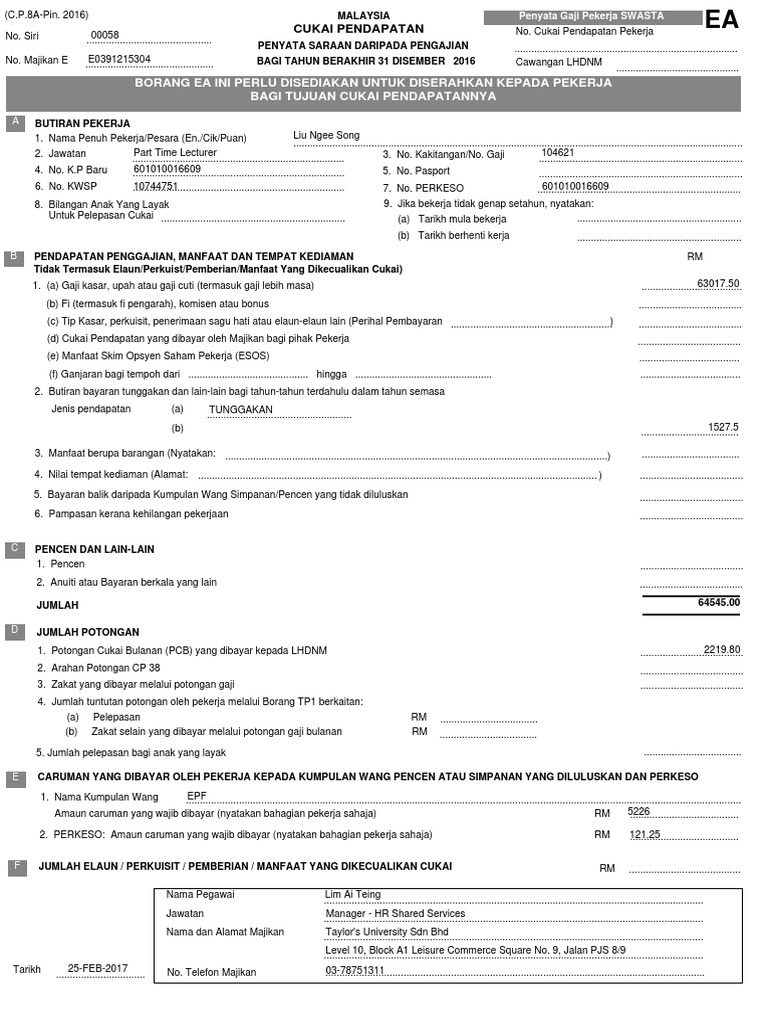

Borang e and ea. Failure to do so will result in the irb taking legal action against the company s director. Aklumat melalui e data praisi tidak perlu mengemukakan borang c p 8d. It s time to prepare borang ea form ea or c p 8a borang e form e or c p 8d for your employees. In this article we will show how you can generate them easily.

To generate past years payroll record and tax forms such as borang ea form ea or c p. Talenox offers a convenient way for companies in malaysia to import their employee data. B kegagalan mengemukakan borang e pada atau sebelum 31 mac 2019 adalah menjadi satu kesalahan di bawah perenggan 120 1 b akta cukai pendapatan 1967 acp 1967. 8a borang e form e or c p.

B failure to furnish form e on or before 31 march 2019 is an offence under paragraph 120 1 b of the income tax act 1967 ita 1967. E data praisi need not complete and furnish c p 8d. How to generate borang e and ea and perform e data praisi submission to lhdn. On and before 30 4 2020.

C kegagalan menyedia dan menyerahkan borang ea ec kepada pekerja pada atau sebelum 28 februari 2019 adalah. So now as a hr and payroll administrator how do you generate the borang e and ea and e data praisi submission to lhdn easily.