Borang E E 2019

Individu perkongsian pertubuhan harta pusaka dan keluarga sekutu hindu borang nyata bagi tahun taksiran 2018 penyediaan sistem e filing untuk.

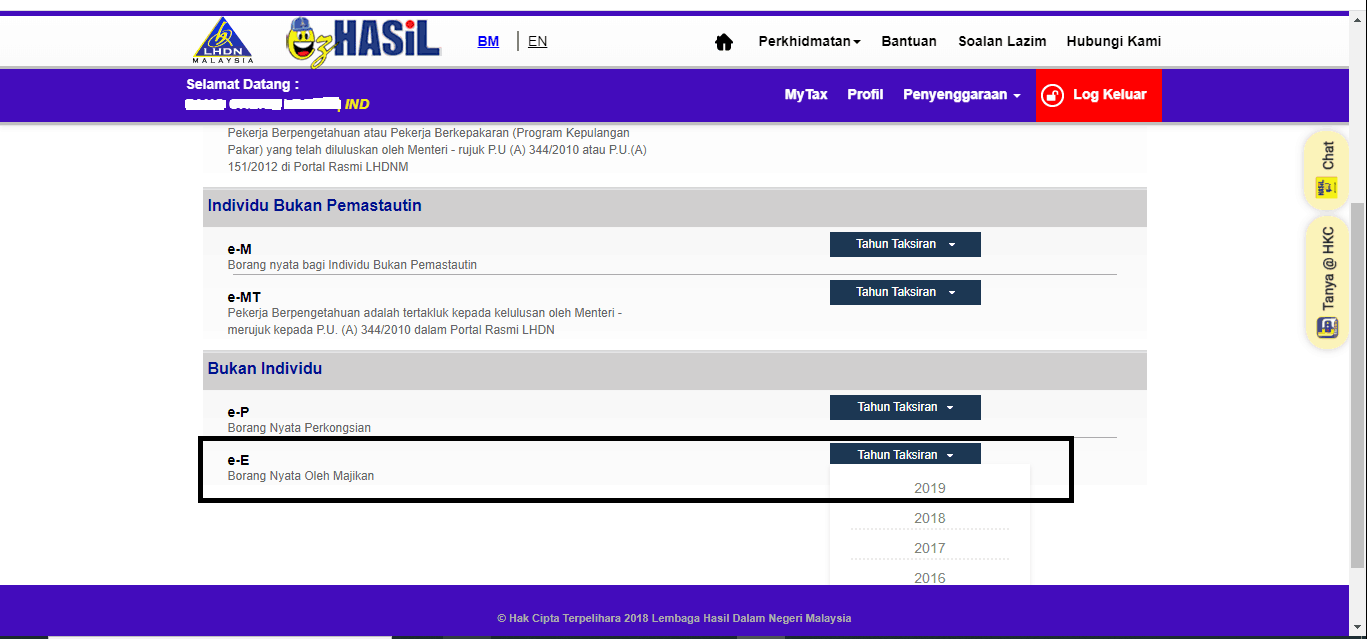

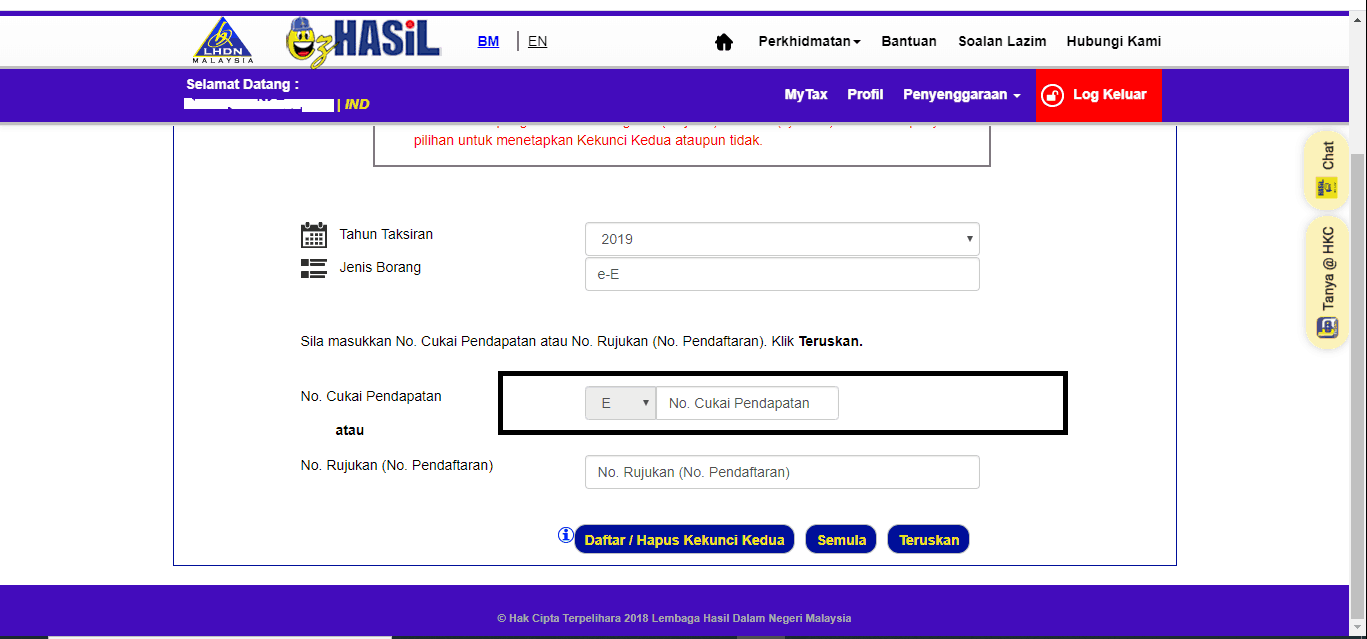

Borang e e 2019. Setiap syarikat mesti mengemukakan borang e menurut peruntukan seksyen 83 1 akta cukai pendapatan. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019. Majikan penyata bagi tahun saraan 2018 1. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah.

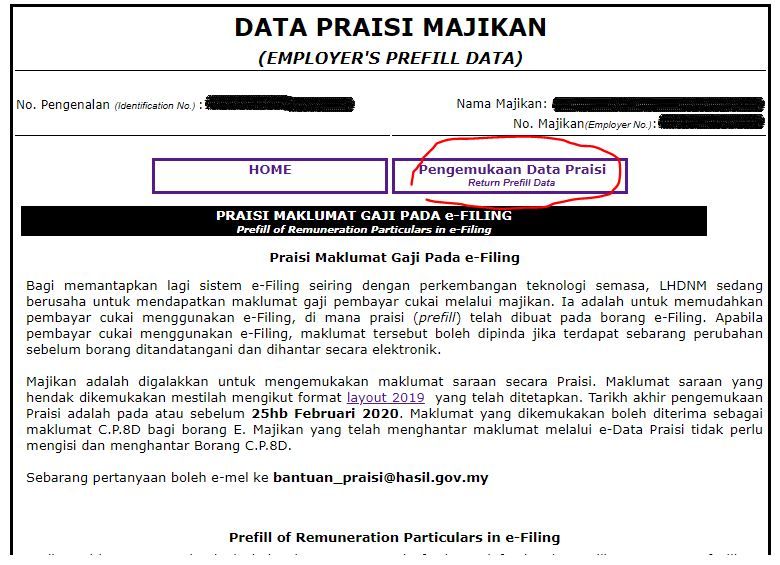

Other than e data praisi and e filing e e c p 8d must be submitted in excel or txt file format by using compact disc usb drive external hard disk. 1 2019 cp8 pin. 2019 borang saraan bagi tahun 1 majikan seperti didaftarkan e no. B kegagalan mengemukakan borang e pada atau sebelum 31 mac 2019 adalah menjadi satu kesalahan di bawah.

D p e p perkongsian program memfail borang nyata bn bagi tahun 2019. Majikan syarikat syarikat labuan 3. Majikan yang aklumat melalui e data praisi tidak perlu mengemukakan borang c p 8d. Majikan 2 e 3 status majikan 1 kerajaan 2 berkanun 3 pihak berkuasa tempatan.

E e e e i. 2019 c p 8d has 18 columns to be filled up per employee basis which requires extensive information and the coverage of all ranges of remuneration i e. Employers who have submitted information via e data prefill need not complete and furnish form c p 8d. Nota panduan pengemukaan a.

An employer is required to complete this statement on all employees for the year 2019. 31 mac 2019 a borang e hanya akan dianggap lengkap jika c p 8d dikemukakan pada atau sebelum 31 mac 2019.