Borang E Employer

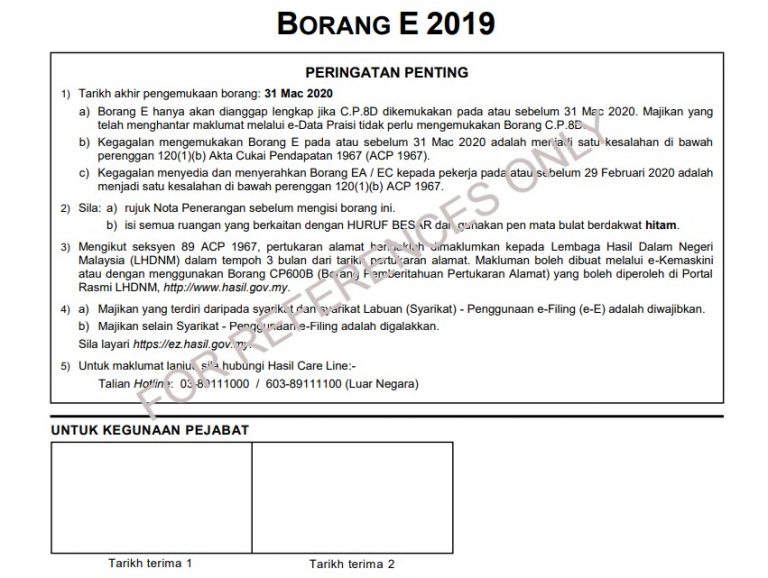

A form e will only be considered complete if c p 8d is submitted on or before 31 march 2019.

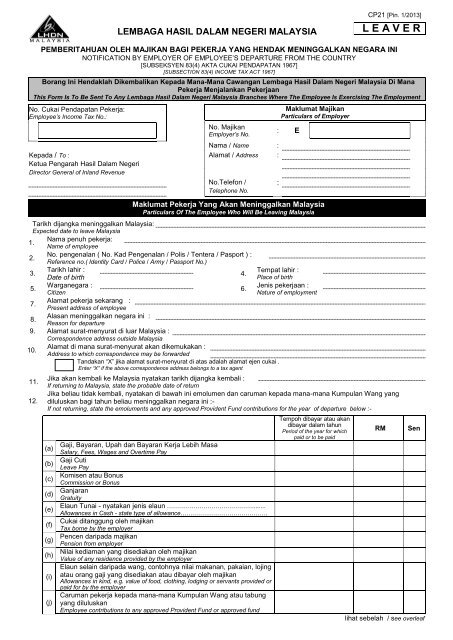

Borang e employer. B failure to furnish form e on or before 31 march 2019 is an offence under paragraph 120 1 b of the income tax act 1967 ita 1967. Borang e is an employer s annual return of remuneration for every calendar year and due for submission by 31st march of the following calendar year. Every employer shall for each year furnish to the director general a return in the prescribed form click here to read. How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967.

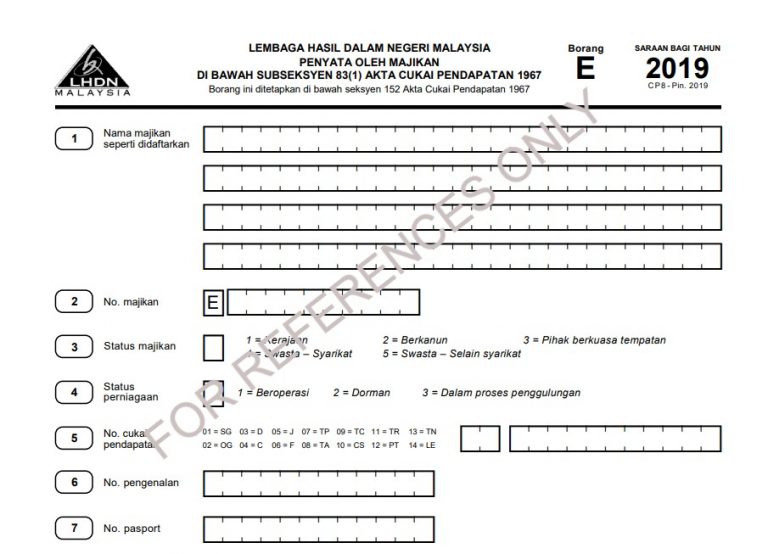

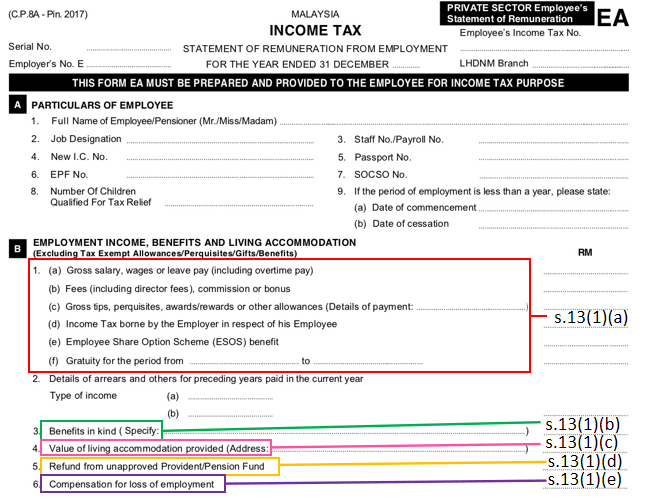

E remuneration for the year return form of employer 1 name of employer as registered employer s no. 8 with ccm or others date received 1 date received 2 date received 3 for office use. Email confirmation from lhdn. However employers are mandatory to furnish form e online via e filing effective year of assessment 2016 which is due for submission in year 2017.

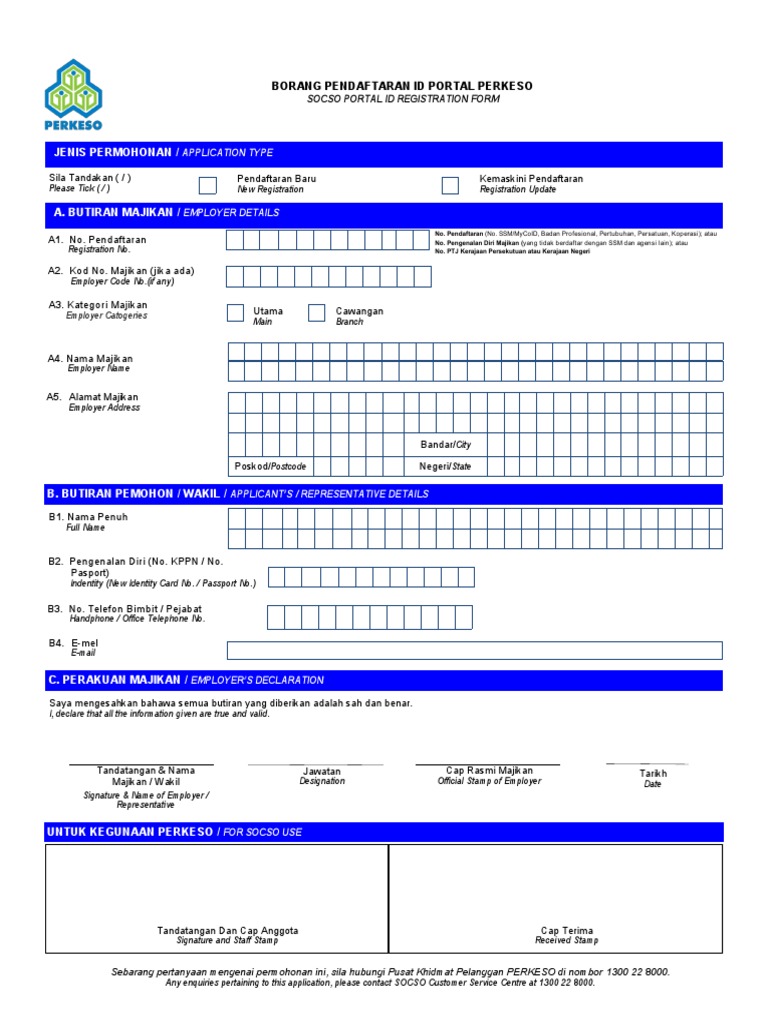

Employers may still submit form e manually to irb this year for year of assessment 2015 submission. 06 apr 2020 employers can now easily access all the forms you need when it comes to registration updates and also contribution in one central location. 2 e 3 status of employer 1 government 2 statutory 3 private sector income tax no. On and before 30 4 2020.

Fill in company s full name. Activating the free e caruman service involves several steps but once they are done the following monthly processes should be a breeze. Fill in company s full address including postcode. Employers who have e data praisi need not complete and furnish c p 8d.

6 4 income tax no. Passport no 7 registration no. 1 for reference only cp 8 pin. Employer forms last updated.

With companies commission of. E 908915 10 fill in as 0090891510 e 3943914 03 fill in as 0394391403 e 90001541 01 fill in as 9000151401. Besides registering for i akaun employer employers must also make sure to fulfil specific requirement before they are able to start conducting transactions. All companies sdn bhd must submit online for 2018 form e and.

Setiap syarikat mesti mengemukakan borang e menurut peruntukan seksyen 83 1 akta cukai pendapatan 1967 akta 53. Fill in the employer s income tax number using10 digits.