Borang E For Dormant Company

Companies that are dormant or have not commenced business are also required to furnish the form e ea with effect from year of assessment.

Borang e for dormant company. The irbm verbally confirmed that this means a dormant company is not required to submit the form cp204 as long as it did not commence operations. Failure to do so will result in the irb taking legal action against the company s director. Irb has taken action against 65 392 company and non company employers for not submitting the form e for year of assessment 2014. Borang c perlu dikemukakan kepada lhdnm dalam tempoh tujuh bulan selepas tarikh penutupan akaun.

An irbm branch indicated that since the dormant company is required to file the itrf with. What if you fail to submit borang e and cp8d. Important that employer know how to complete borang e ea accurately and submit it to inland revenue lhdn before the stipulated deadline. Have you prepared your form e.

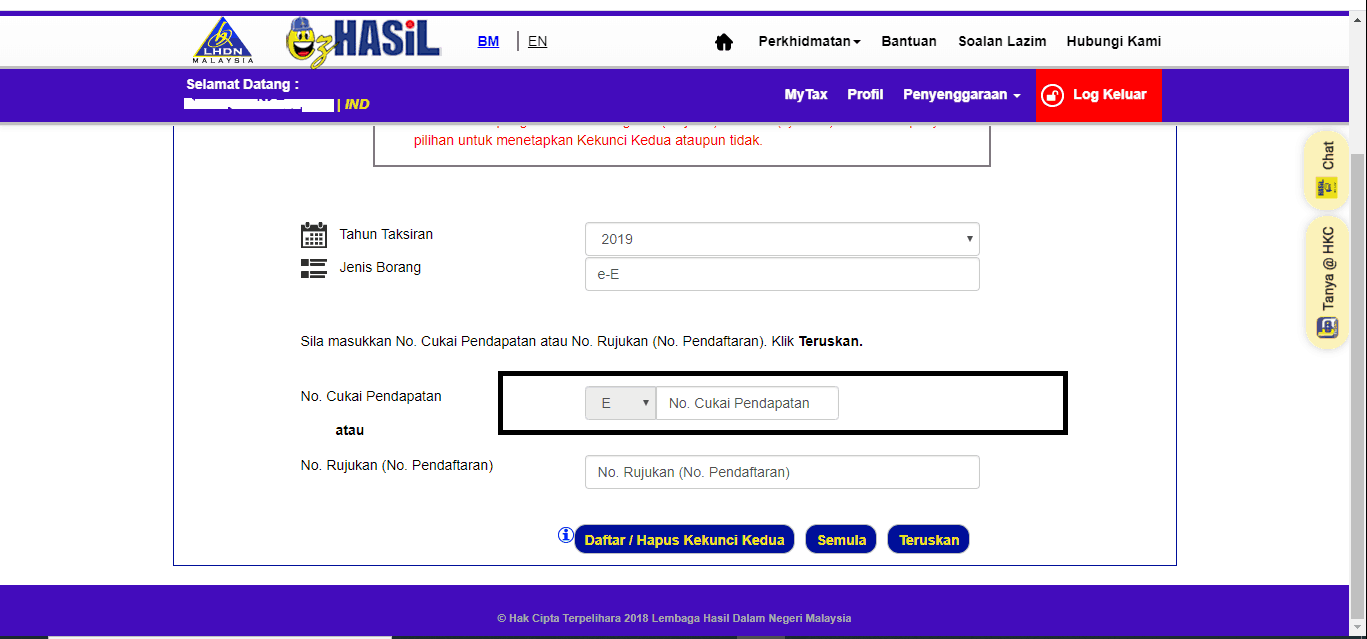

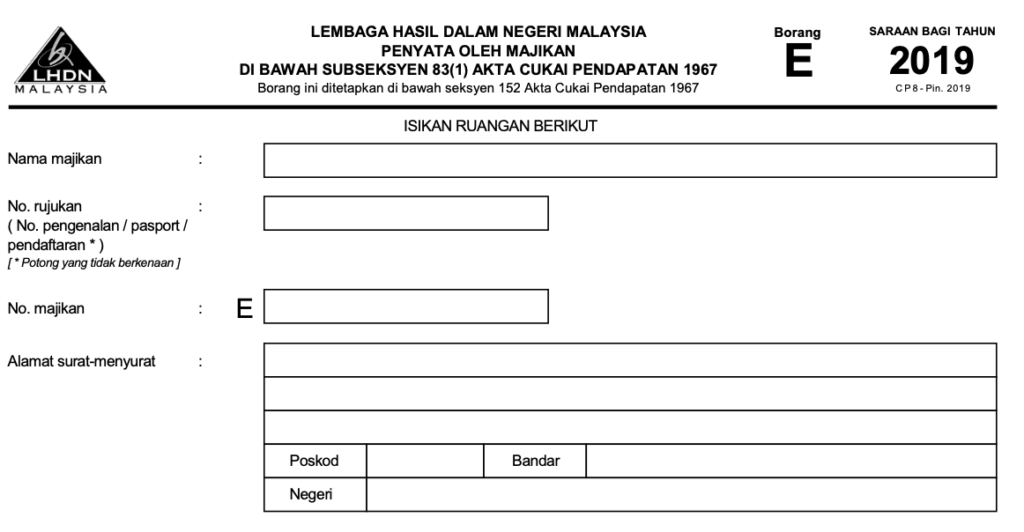

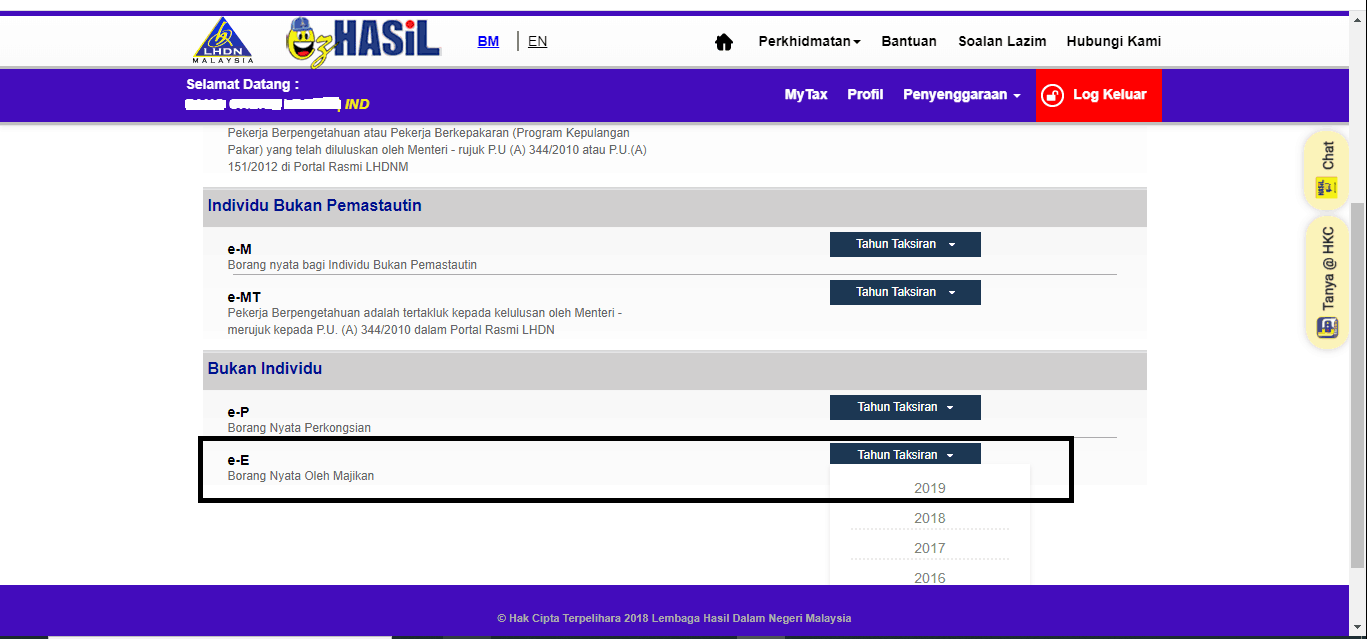

Any dormant or company not in operation are also required to submit form e borang e as well. To educate business owners on how to fill up borang e ea correctly. An irbm branch indicated that since the dormant company is required to file the itrf with effect from ya 2014 it should also submit the form cp204 for ya 2014. How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967.

Starting from 2016 onwards all company is made mandatory to submit form e borang e regardless whether they have employees or do not have any employees. Mulai tahun taksiran 2014 syarikat perkongsian liabiliti terhad badan amanah dan koperasi yang dorman dan atau yang belum menjalankan perniagaan hendaklah mengemukakan bncp termasuk borang e untuk keterangan lanjut sila rujuk program memfail bncp bagi tahun 2020. Means a dormant company is not required to submit the form cp204 as long as it did not commence operations. Did you notice that sdn bhd are required to file form e irrespective active or dormant with or without employees.

Kami sedia maklum bahawa pembayar pembayar cukai seperti yang tertera di perenggan 2 2 b dikehendaki mengemukakan borang e bagi tahun pengajian 2014 walau. Therefore all employers must submit form e. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Irb has taken action against 65 392 employers.

Even a dormant company must submit form e. It is important that employer know how to complete form e accurately.