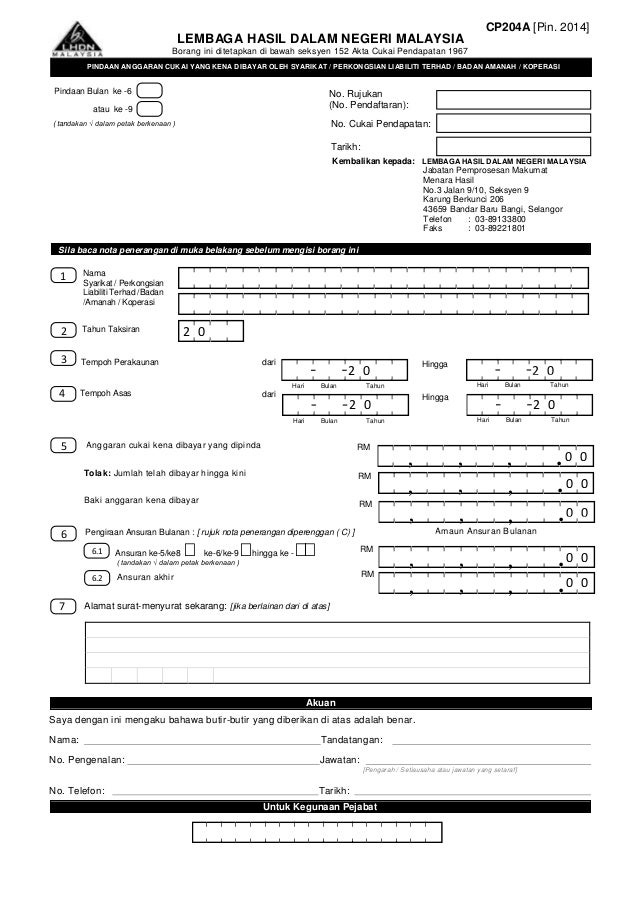

Borang E For Partnership

ð isikan 0 di bahagian a dan bahagian b borang e 2010.

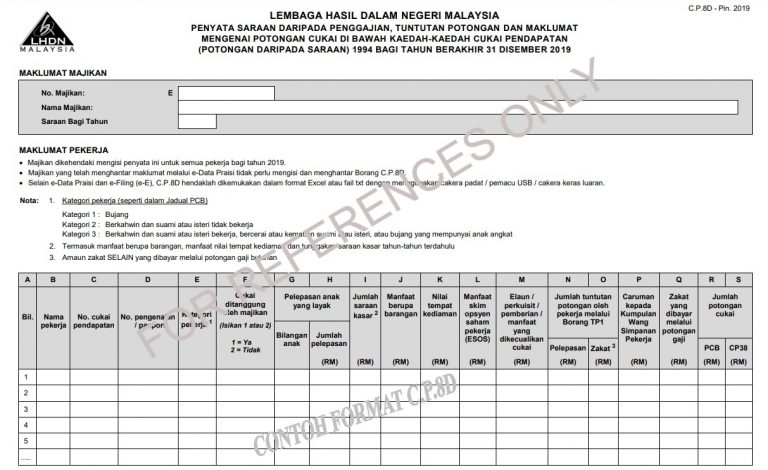

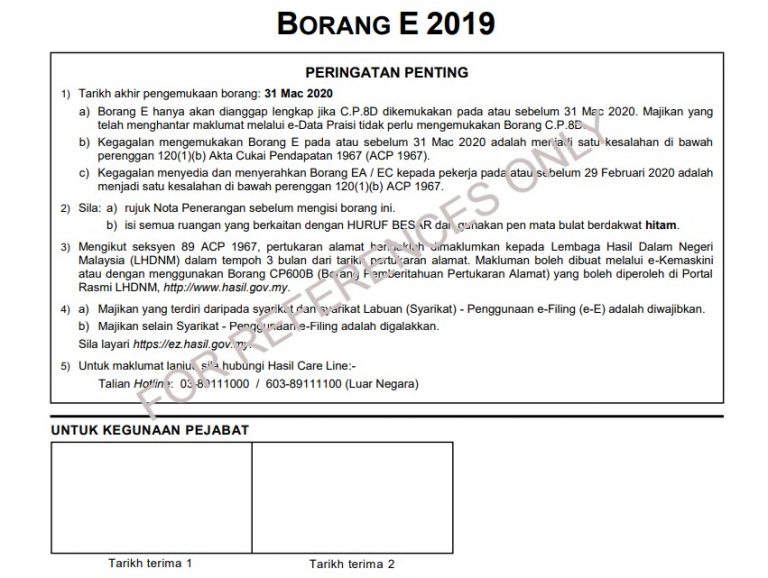

Borang e for partnership. Nota penerangan borang p form p explanatory note. ð menghantar surat makluman ke cawangan di mana fail majikan berada untuk tindakan supaya borang e tidak lagi dikeluarkan pada masa akan datang sehinggalah syarikat tersebut beroperasi semula. Registration is not required if the partnership is dormant. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees.

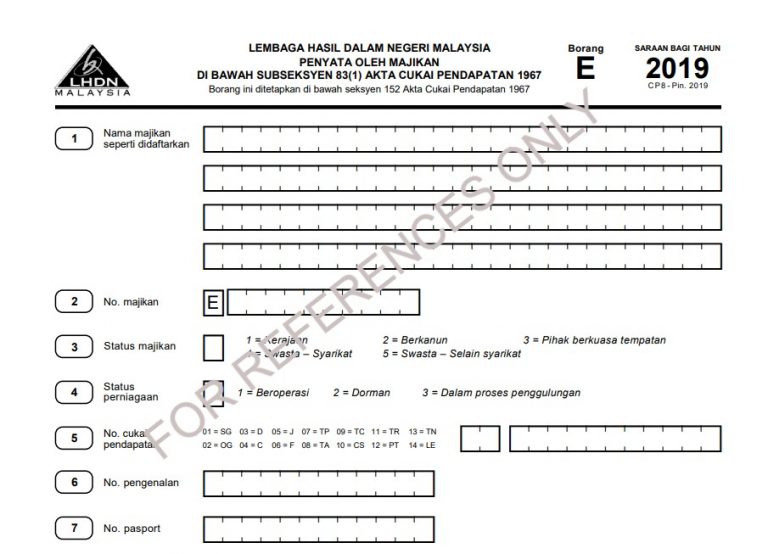

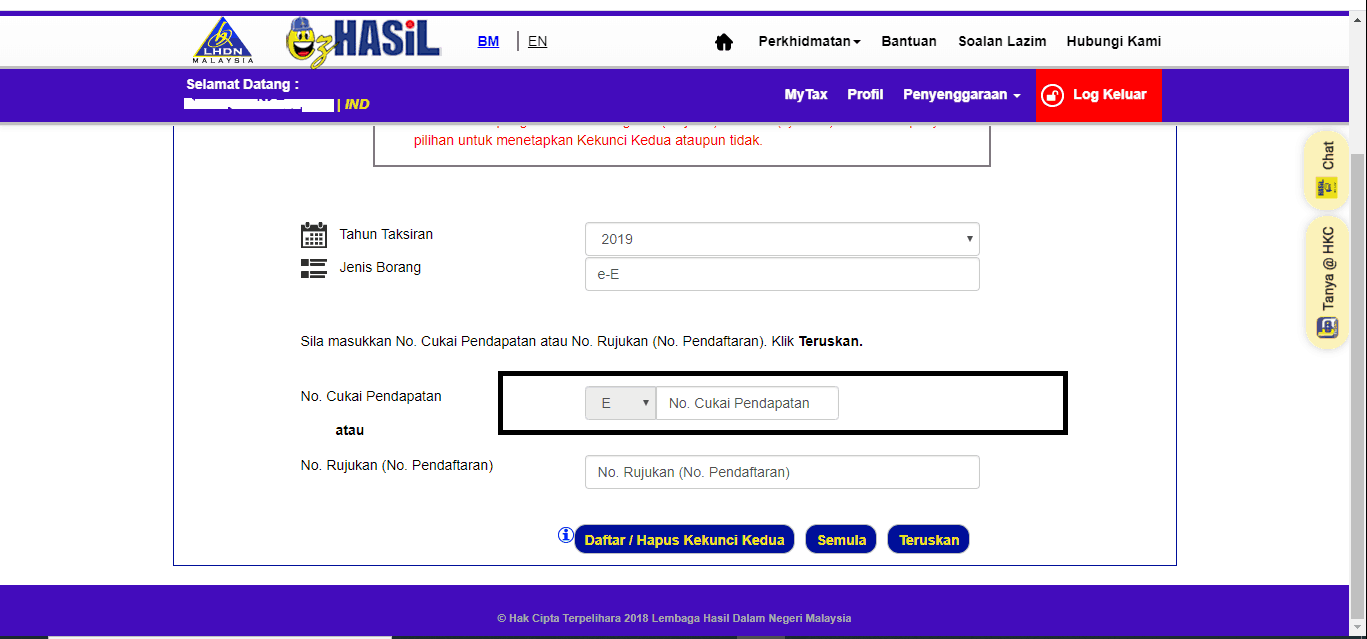

Akuan tandatangan declaration signing. How to register tax file application to register an income tax reference number can be made at the nearest branch to your correspondence address or at any irbm branch of your convenience without reference to your correspondence address or regester on line via e daftar. Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. On and before 30 4 2020.

ð borang e yang diterima itu perlu dilengkapkan dan ditandatangani. Maklumat firma ejen cukai particulars of tax agent s firm. Failure to do so will result in the irb taking legal action against the company s director. Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year.