Borang E Guidelines

Majikan yang telah menghantar maklumat melalui e data praisi tidak perlu mengisi dan menghantar c p 8d.

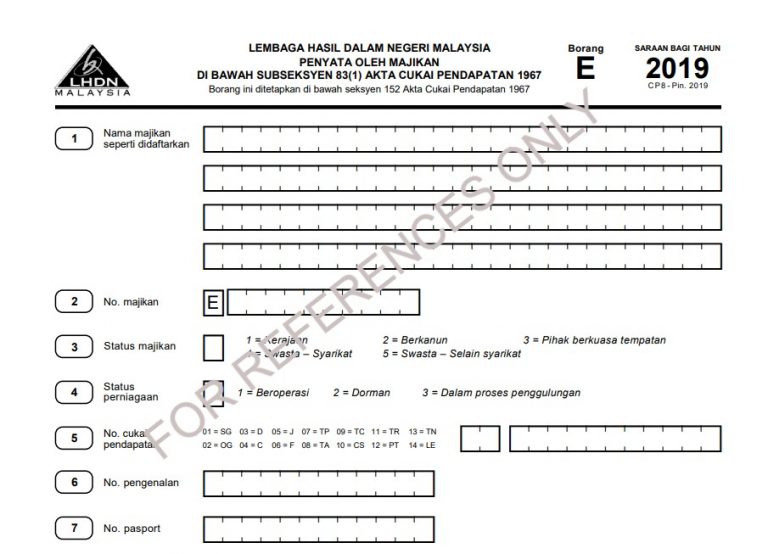

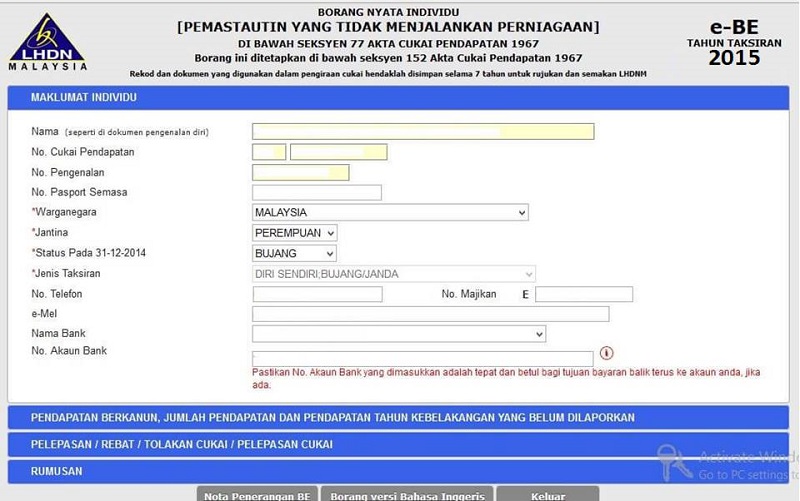

Borang e guidelines. Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. In borang 3 4 5 your master is the applicant pemohon as opposed to borang 1 2 which you are the petitioner pempetisyen. Pada skrin e borang pilih jenis borang dan klik tahun taksiran yang berkaitan. The sections cited are also different.

Panduan pengguna e borang ezhasil versi 3 2 6 1 2 e borang pengguna akan dipaparkan skrin perkhidmatan apabila telah berjaya log masuk sistem ezhasil. ð borang e yang diterima itu perlu dilengkapkan dan ditandatangani. Majikan yang aklumat melalui e data praisi tidak perlu mengemukakan borang c p 8d. ð isikan 0 di bahagian a dan bahagian b borang e 2010.

B kegagalan mengemukakan borang e pada atau sebelum 31 mac 2019 adalah menjadi satu kesalahan di bawah. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. 31 mac 2019 a borang e hanya akan dianggap lengkap jika c p 8d dikemukakan pada atau sebelum 31 mac 2019. In borang 1 2 the correct section to be cited are s 10 s 15 while in borang 3 4 5 the correct section to be cited are s 36 2 a b.

Instruction for author manuscript preparation writing and revision guidelines preparation. Sistem ezhasil akan memaparkan skrin e borang seperti di bawah. 1 the manuscript should be in the form of a study in the field of accounting finance and investment. What if you fail to submit borang e and cp8d.

Personal e mail submission preparation checklist as part of the submission process authors are required to check off their submission s compliance with all of the following items and submissions may be returned to authors that do not adhere to these guidelines. Borang e hanya akan dianggap lengkap jika c p 8d dikemukakan pada atau sebelum tarikh akhir pengemukaan borang. Klik pautan e borang di bawah menu e filing. Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year.

Borang e is an employer s annual return of remuneration for every calendar year and due for submission by 31st march of the following calendar year. Majikan digalakkan mengemukakan c p 8d secara e filing sekiranya borang e dikemukakan melalui e filing. This is a new author guidelines going to be effective for january 2019 issue. Failure to do so will result in the irb taking legal action against the company s director.