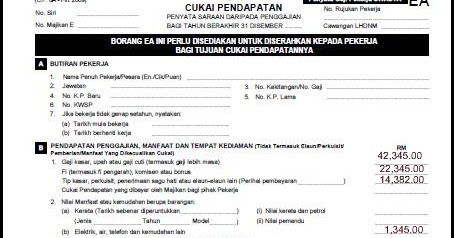

Borang E Income Tax

The due dates for submission are as follow.

Borang e income tax. How to file your personal income tax online in malaysia. If you are an individual with non business income choose income tax form be e be and choose the assessment year tahun taksiran 2018. After clicking on e borang then you will be shown a list of income tax forms. Remember you file for 2018 income tax in 2019.

The deadline for filing income tax return forms in malaysia has been extended by two months. What if you fail to submit borang e and cp8d. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. Berita cukai borang b borang be fail cukai pendapatan income tax maklumat cukai.

Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. Pembayar cukai yang baru atau pertama kali melaporkan pendapatan menyamai melebihi rm 450 000 dimaklumkan bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac. Employers form e by 31 march 2017. Gone are the days of queuing up in the wee hours of the.

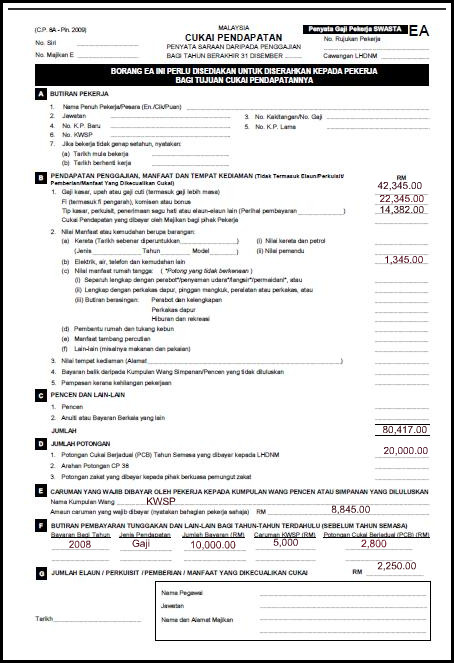

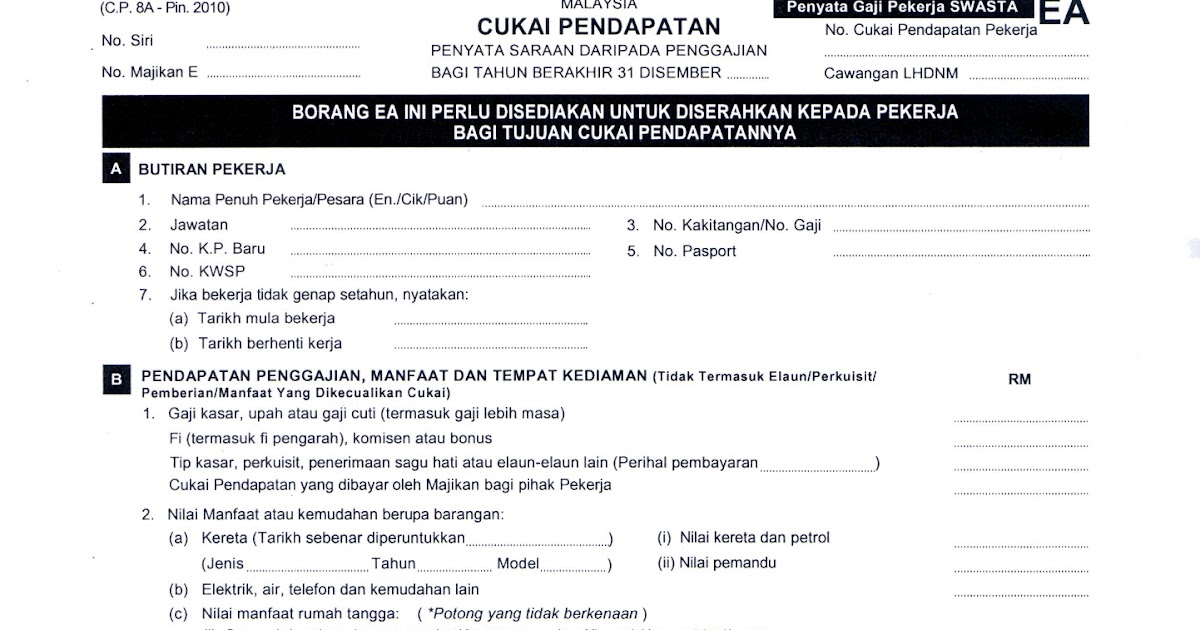

Residents and non residents with non business income form be and m by 30 april continue reading borang tp 1 tax release form. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Kongsi ke twitter kongsi ke facebook kongsi ke pinterest label. You can file your taxes on ezhasil on the lhdn website.

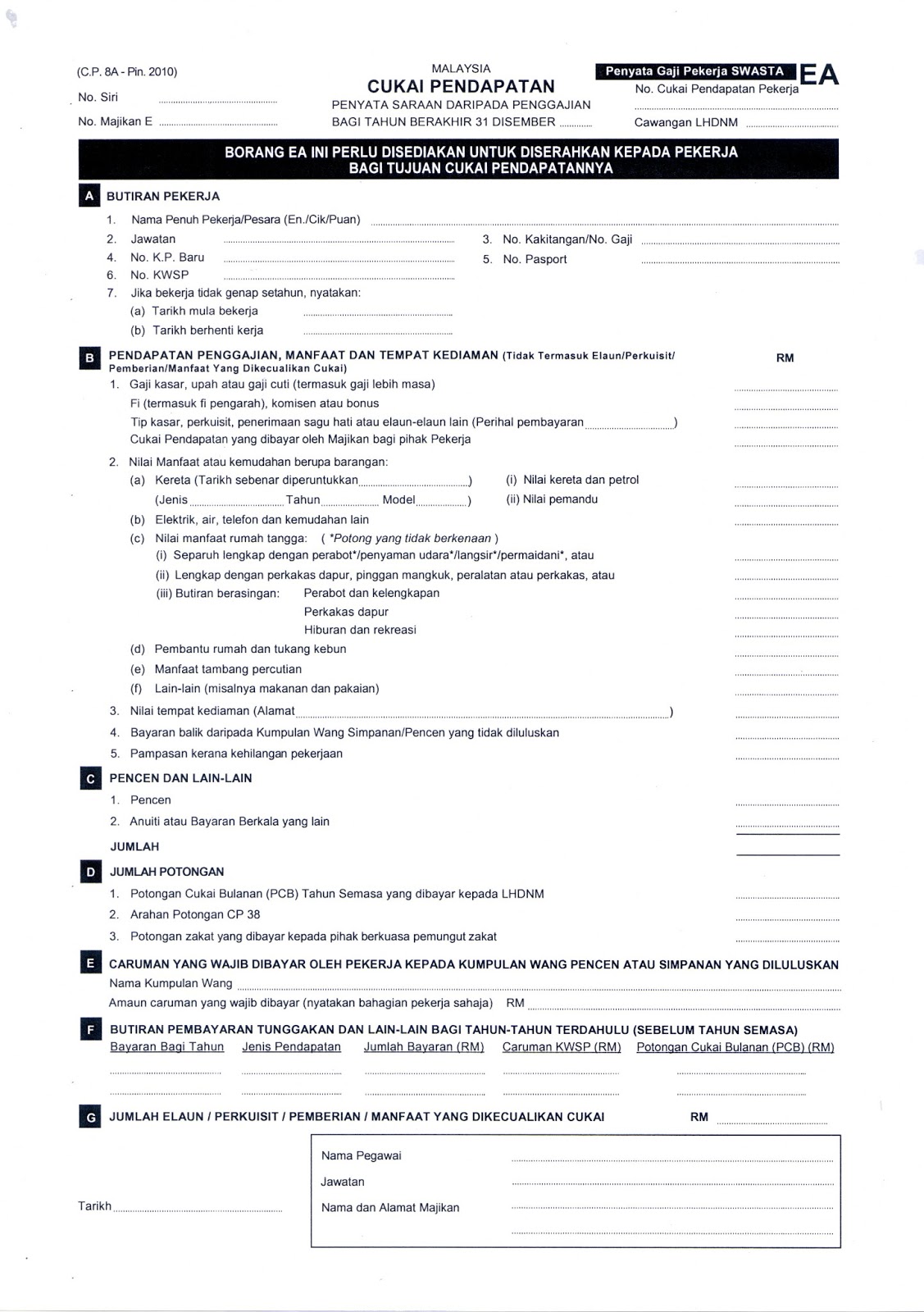

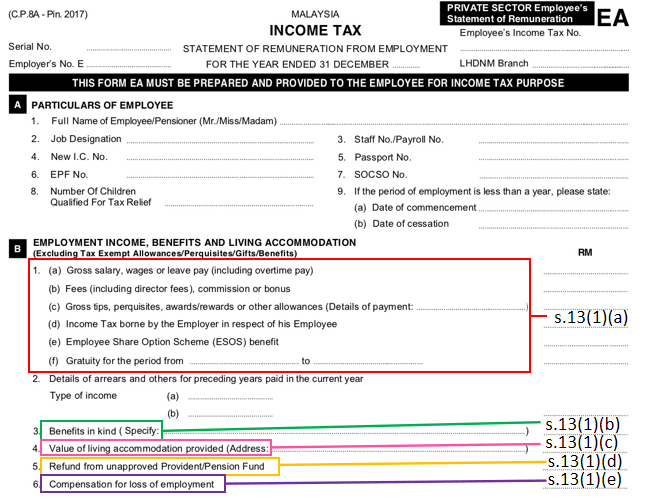

The next thing you should do is to file your income tax do it online. How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020. The 2016 assessment year goes according to the calendar year meaning you will be filing your income tax return forms for 1 january 2016 to 31 december 2016.

Failure to do so will result in the irb taking legal action against the company s director. Program memfail borang nyata bn bagi tahun 2020.