Borang E Submission 2018

B form e and c p 8d must be submitted in accordance with the format as provided by lhdnm.

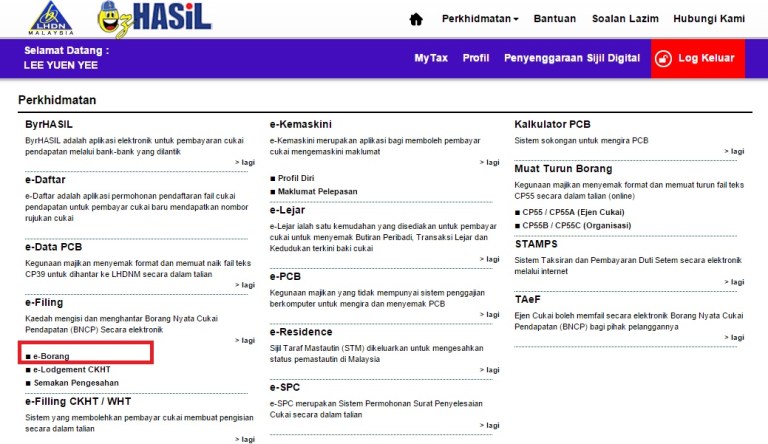

Borang e submission 2018. Email confirmation from lhdn. Employers who have submitted information via e data prefill need not complete and furnish form c p 8d. Setiap syarikat mesti mengemukakan borang e menurut peruntukan seksyen 83 1 akta cukai pendapatan 1967 akta 53. 2018 borang saraan bag i tahun e lembaga hasil dalam negeri malaysia penyata oleh majikan cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 tarikh terima 1 tarikh terima 2 untuk kegunaan pejabat e.

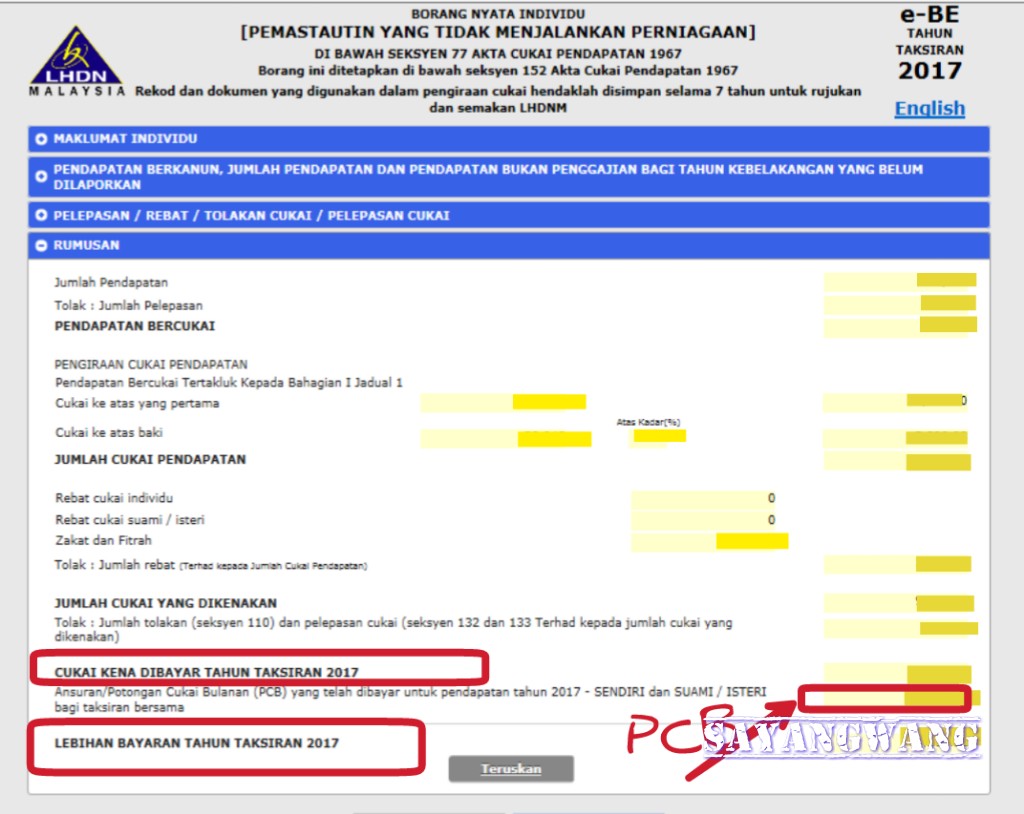

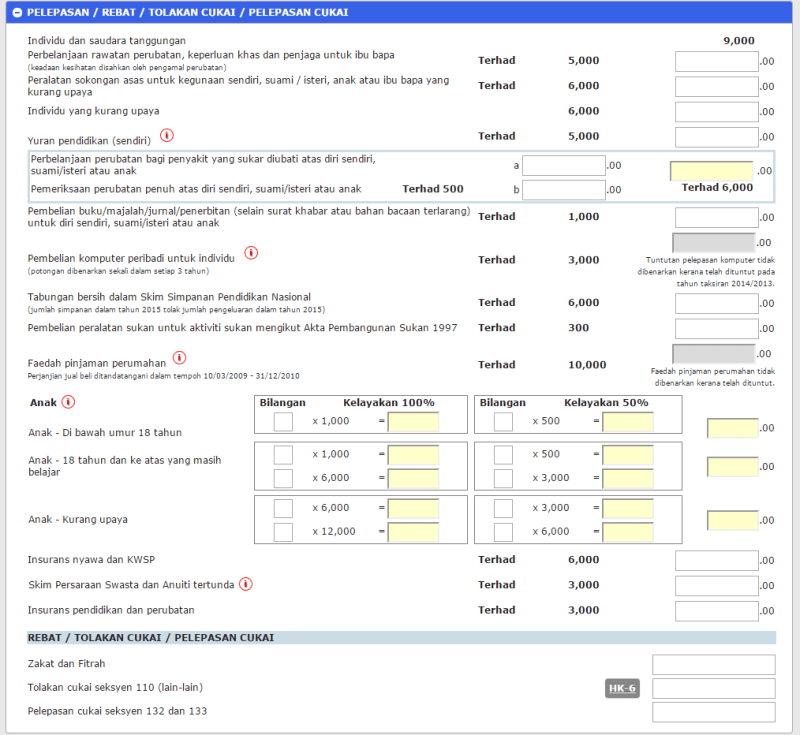

1 bersama bora 2018 cp8 pin. Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. Every employer shall for each year furnish to the director general a return in the prescribed form click here to read. Berikut adalah tarikh hantar borang cukai pendapatan taksiran 2017.

Nama 5 7 negeri no. Form e and c p 8d which do not comply with the format as stipulated. Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year. All companies sdn bhd must submit online for 2018 form e and.

Lembaga hasil dalam negeri lhdn melalui lampiran telah memaklumkan yang p embayar cukai boleh mengemukakan borang nyata cukai pendapatan bncp tahun taksiran 2017 mereka mulai 1 mac 201 8. Deduction from remuneration 1994 for the year ended 31 december 2018 an employer is required to complete this statement on all employees for the year 2018.