Borang E Submission Deadline 2020

1 tarikh akhir pengemukaan borang.

Borang e submission deadline 2020. B kegagalan mengemukakan borang e pada atau sebelum 31 mac 2020 adalah menjadi satu kesalahan di bawah. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Failure to do so will result in the irb taking legal action against the company s director. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019.

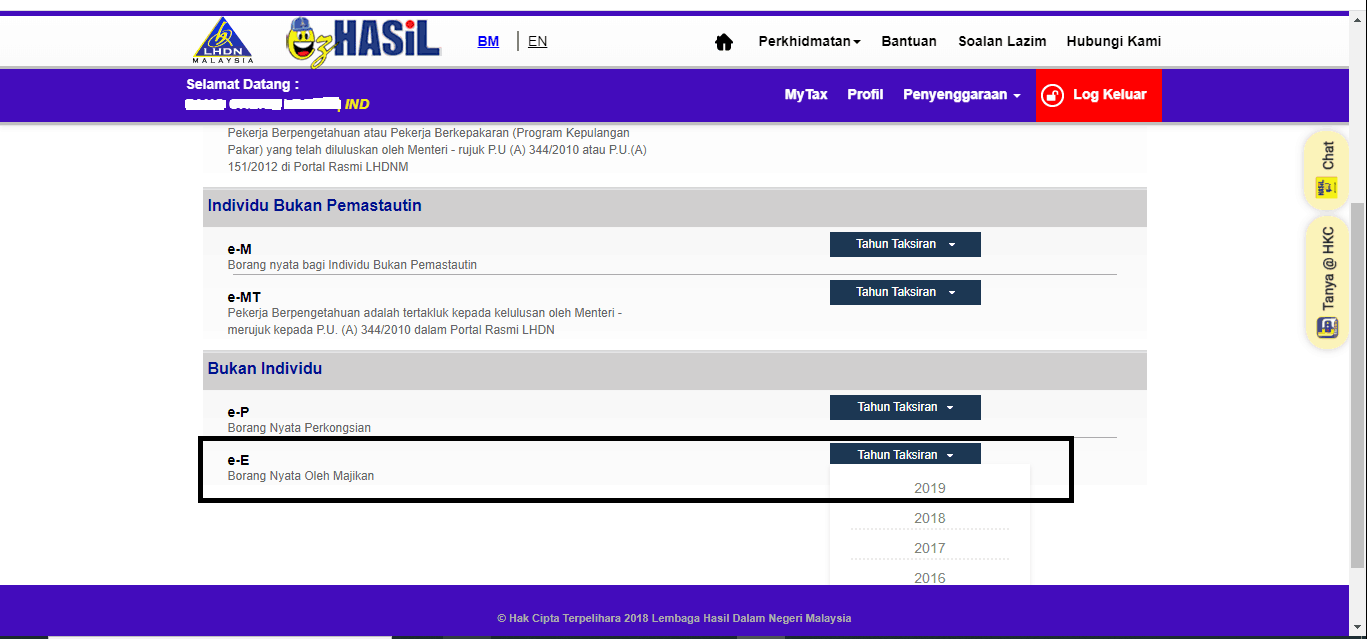

Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30. Every company needs to submit your form e. 7 00 malam hingga 7 00 pagi. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah.

Borang e is an employer s annual return of remuneration for every calendar year and due for submission by 31st march of the following calendar year. Lhdnm memohon maaf atas sebarang kesulitan yang mungkin timbul namun penyelenggaraan ini adalah perlu bagi memastikan kesinambungan penyampaian perkhidmatan kepada semua. 02 april 2020 khamis hingga 03 april 2020 jumaat. What if you fail to submit form e.

Who needs to file the form e. 31 mac 2020 a borang e hanya akan dianggap lengkap jika c p 8d dikemukakan pada atau sebelum 31 mac 2020. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. Lhdnm memohon maaf atas sebarang kesulitan yang mungkin timbul namun penyelenggaraan ini adalah perlu bagi memastikan kesinambungan penyampaian perkhidmatan kepada semua.

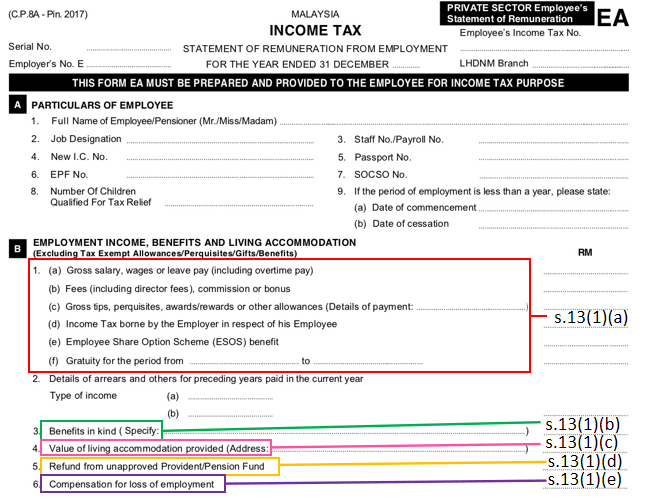

10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia. What is form e. Guide notes on submission of rf 2. Schedule on submission of return forms form type category due date for submission e 2019 employer 31 march 2020 be 2019 resident individual who does not carry on any business 30 april 2020 b 2019 resident individual who carries on business 30 june 2020 p 2019 partnership bt 2019 resident individual knowledge worker expert worker.

Majikan yang aklumat melalui e data praisi tidak perlu mengemukakan borang c p 8d. 31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income. B form e and c p 8d must be submitted in accordance with the format as provided by lhdnm. 02 april 2020 khamis hingga 03 april 2020 jumaat.