Borang Ea Due Date

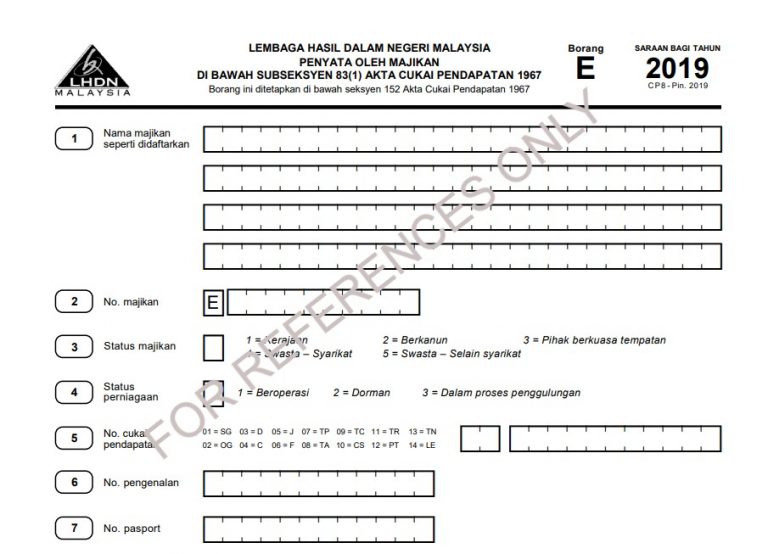

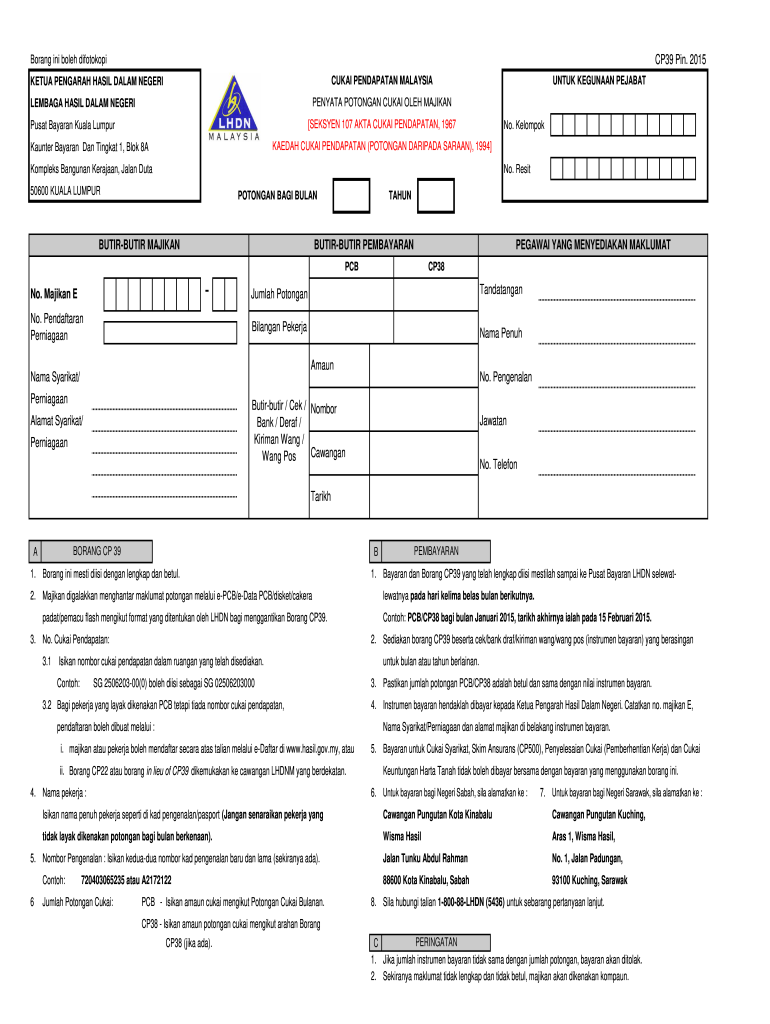

B form e and c p 8d must be submitted in accordance with the format as provided by lhdnm.

Borang ea due date. Tarikh kahwin cerai mati mana mana yang berkenaan. Anggaran cukai yang kena dibayar oleh syarikat perkongsian liabiliti terhad koperasi badan amanah. Borang cp204 cp204a dan cp204b. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

Ii form c p 8a c p 8c ea ec to be rendered to employees. Remember you file for 2018 income tax in 2019. Isi cepat dapat cepat. Bukan selepas tarikh tutup 30 april.

31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income. Due date for submission of the form. Mulai tahun taksiran 2018 syarikat hendaklah mengemukakan anggaran cukai secara elektronik kepada lembaga hasil dalam negeri malaysia. 10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Failure to do so will result in the irb taking legal action against the company s director. Form type category due date for submission e 2019 employer 31 march 2020 be 2019 resident individual who does not carry on any business 30 april 2020 b 2019 resident individual who carries on business 30 june 2020 p 2019 partnership bt 2019 resident individual knowledge worker expert worker 30 april 2020 does not carry on any business. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees.

What if you fail to submit borang e and cp8d. Borang ea daripada majikan anda. Due date for borang be 2015 lhdn borang ea. Antara senarai dokumen yang perlu ada.

Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. Nota panduan borang ea ec. Pembayaran balik untuk cukai yang terlebih bayar selalunya dibuat selepas 13 14 hari daripada tarikh anda menghantar borang. Form e and c p 8d which do not comply with the format as stipulated by lhdnm are unacceptable.

After clicking on e borang then you will be shown a list of income tax forms. By cuitandokter last updated.