Borang Ea Form

Borang cp204 cp204a dan cp204b.

Borang ea form. Jumlah tuntutan potongan oleh pekerja melalui borang tp1 berkaitan. Failure to do so will result in the irb taking legal action against the company s director. Ea form download links found below click this link to see how easy it is to do ea form and e form in actpay although there is a new ea form for year 2016 lhdn has announced that the the old versions of form ea form ec and c p. 8d can still be used for submitting 2016 income.

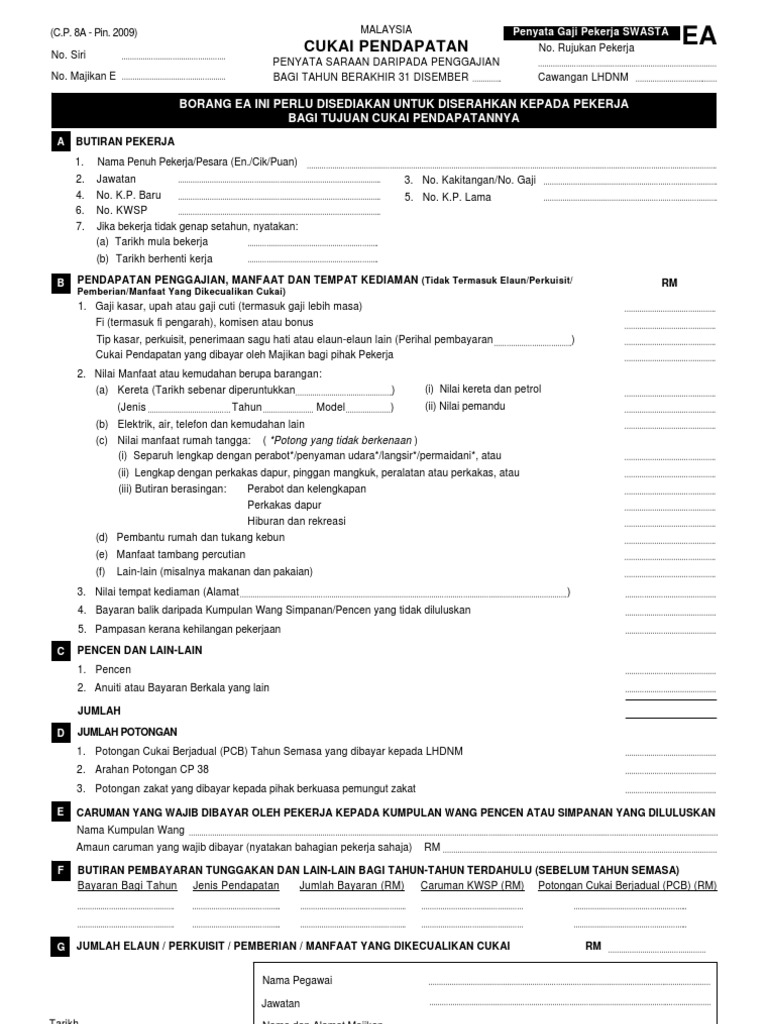

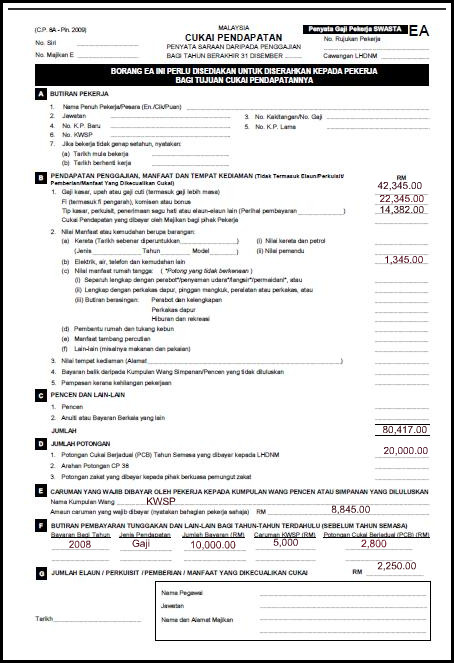

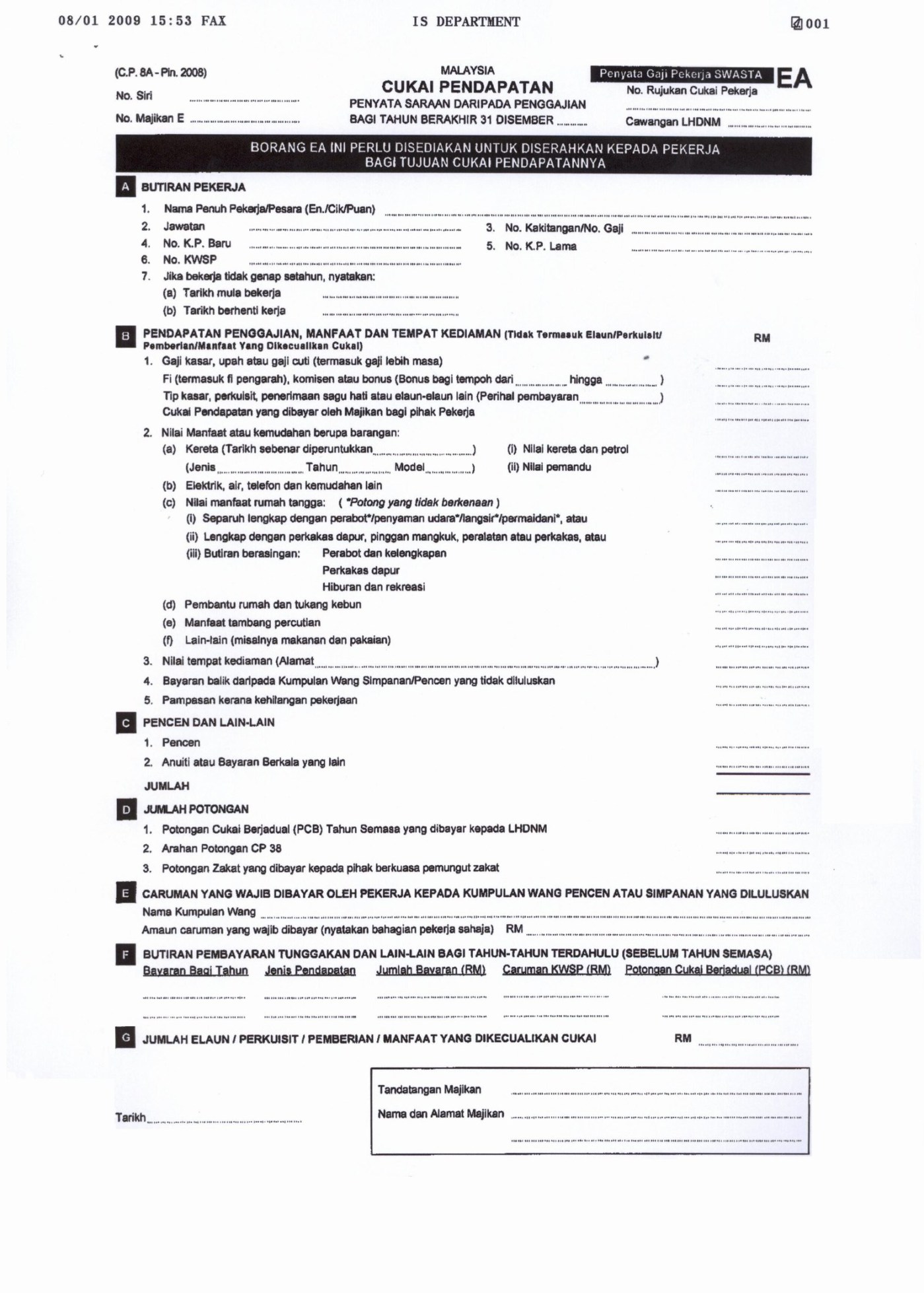

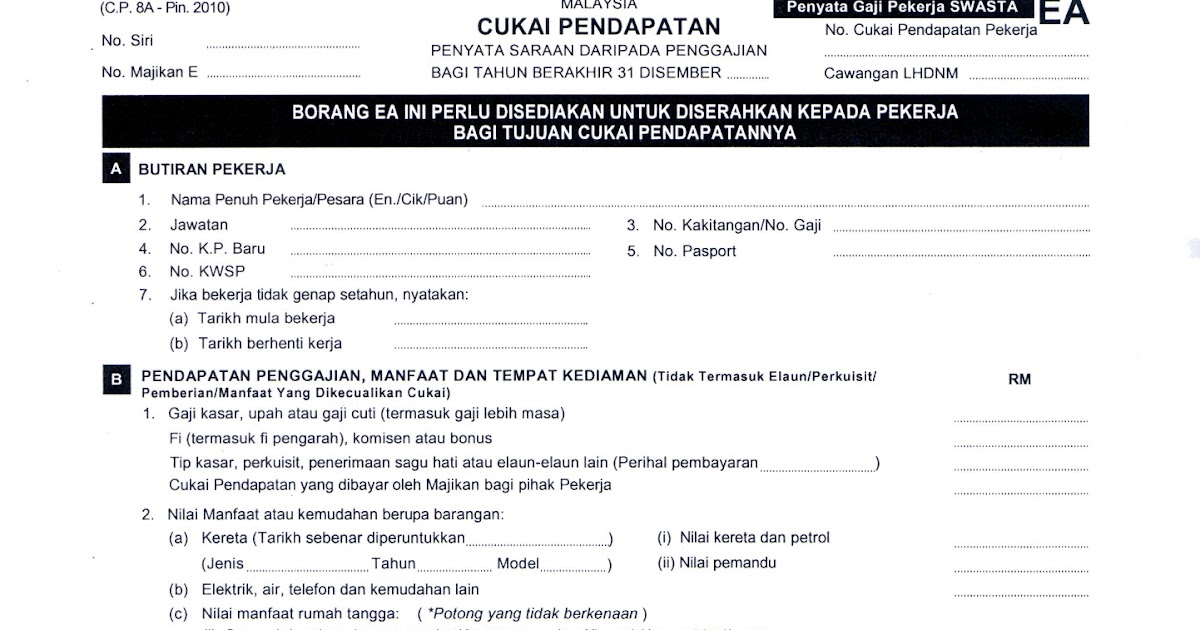

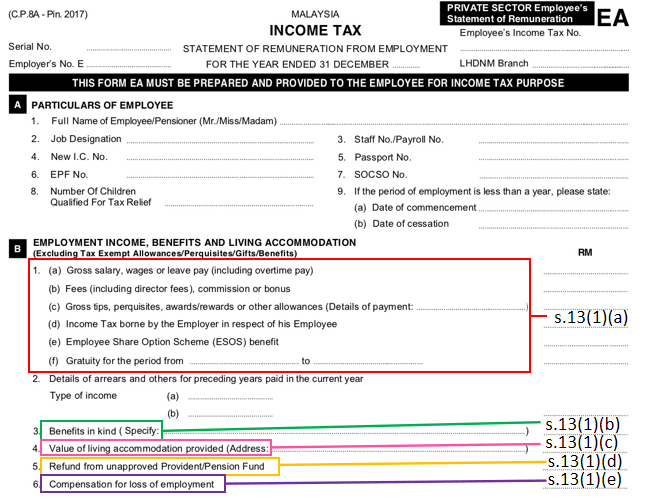

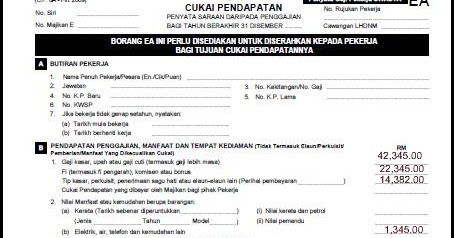

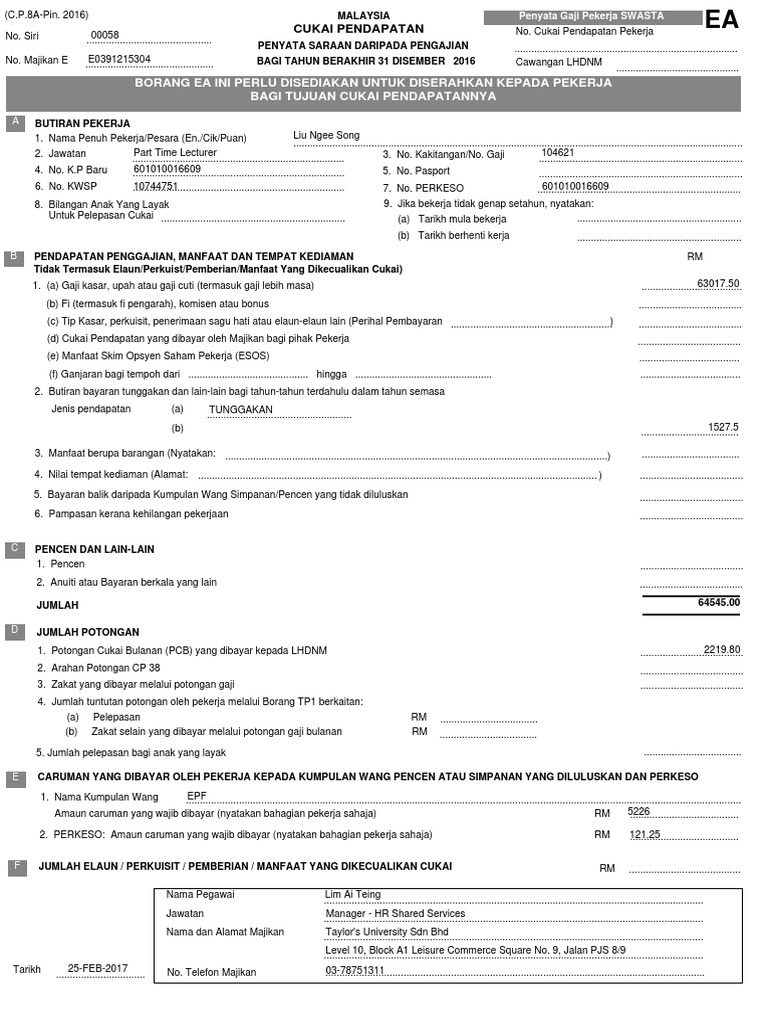

The 2016 assessment year goes according to the calendar year meaning you will be filing your income tax return forms for 1 january 2016 to 31 december 2016. Ea form borang c p 8a overview in accordance with subsection 83 1a of the income tax act 1967 ita 1967 the form c p 8a c p 8c must be prepared and rendered to the employees on or before end of february the following year to enable them to complete and submit their respective return form within the stipulated period. Katakanlah korang ada lantik tax ajen utk isikan borang income tax ni diorang akan mintak ea form ni jugak. Bagi tahun berakhir 31 disember.

Kali ini topik yang diceriterakan adalah borang cp 8a pindaan 2008 atau lebih dikenali sebagai borang ea bagi kakitangan swasta dan juga borang ec bagi agensi kerajaan. Cukai pendapatan pekerja cawangan lhdnm. D pembantu rumah dan tukang kebun 3. Nota panduan borang ea ec.

Employers form e by 31 march 2017. Melainkan korang ada bukak perniagaan enterprise so diorang xkan mintak ea form tapi mintak akaun perniagaan pulak last submission. Anggaran cukai yang kena dibayar oleh syarikat perkongsian liabiliti terhad koperasi badan amanah. Penyata gaji pekerja swasta ea no.

Bagi yang telah lama bekerja pastinya borang ea ec sudah tidak asing lagi buat mereka. Residents and non residents with non business income form be and m by 30 april continue reading borang tp 1 tax release form. Kalo korang x der ea form ni camner nak isi borang income tax tu. On and before 30 4 2020.

Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967.