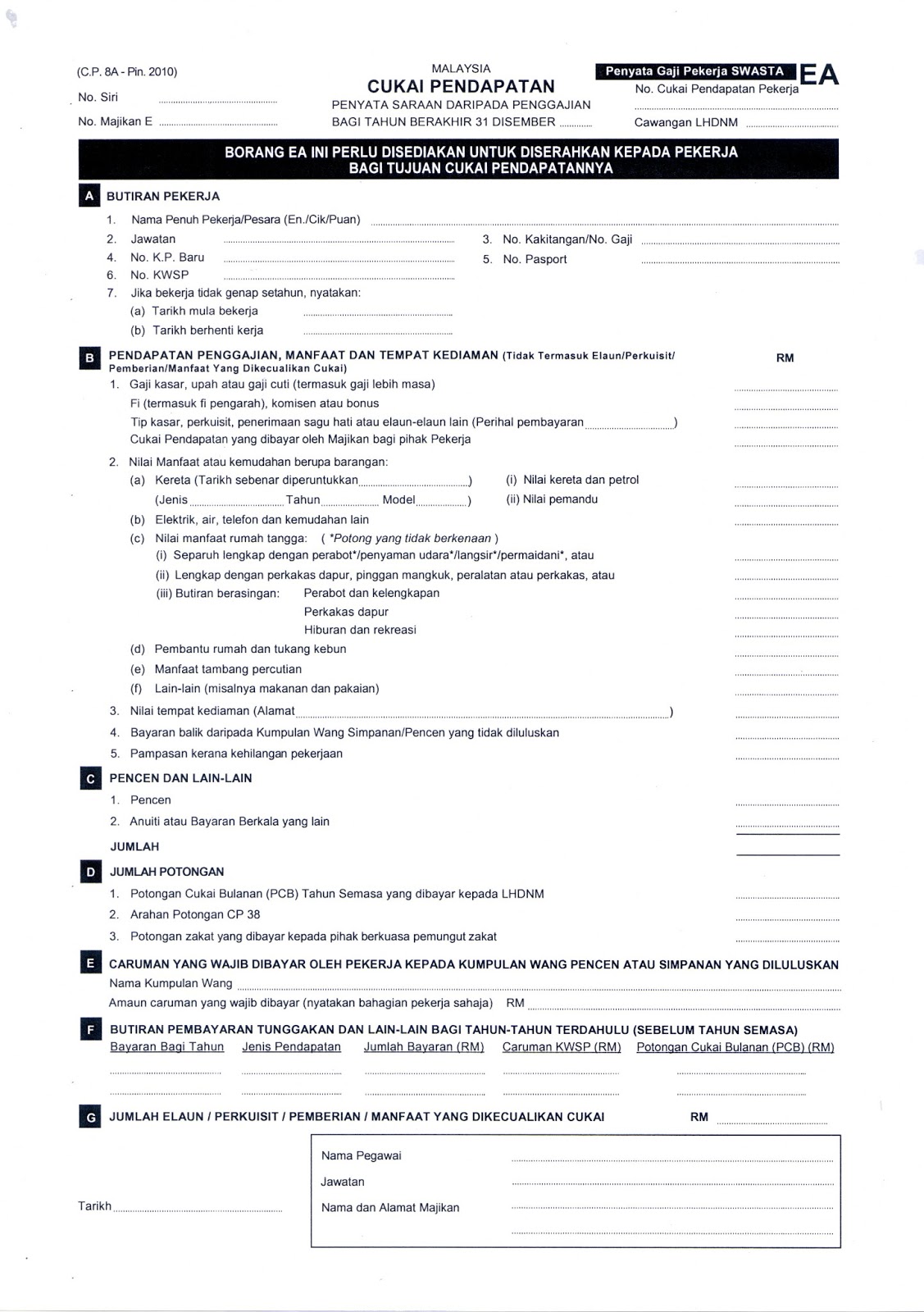

Borang Ea Section F

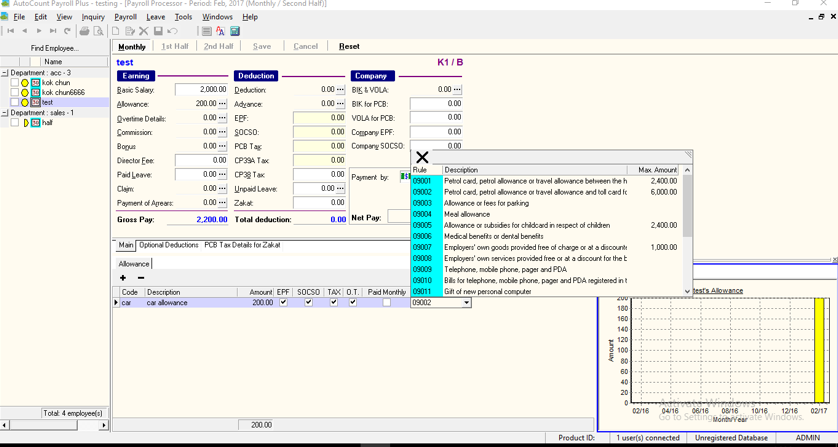

Sekiranya amaun yang diterima melebihi rm6 000 setahun pekerja boleh membuat.

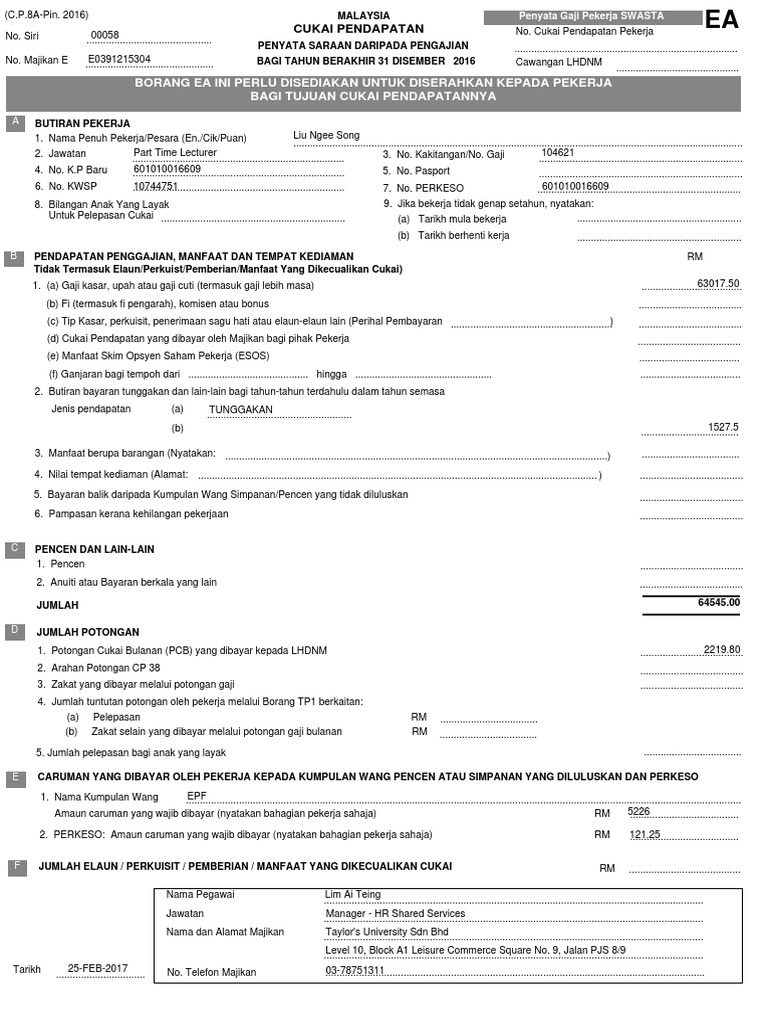

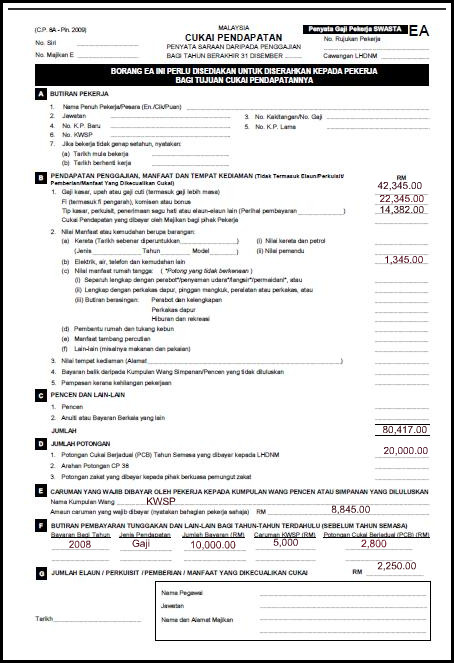

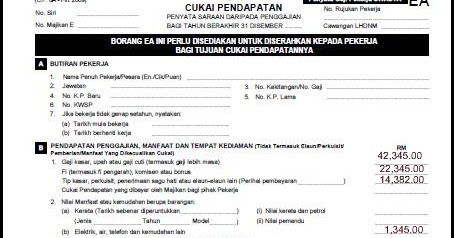

Borang ea section f. Senarai elaun perkuisit pemberian manfaat dikecualikan cukai yang perlu dilaporkan. In the latest revised ea form for tax assessment year 2008 borang c p 8a pin 2008 there are 2 columns for filing your allowances perquisites gifts benefits provided to you by your employer. Column to file taxable allowances perquisites gifts benefits. Tax status for the year of assessment 2008 f1.

Tax payable from e14. A refer to the explanatory notes before filling up this form. B complete all relevant items in block letters and use black ink pen. Income of preceding years not declared fill in relevant information only.

Item b 1 tip kasar perkuisit penerimaan sagu hati atau elaun elaun lain. If this figure does not appear in b18 then something is wrong with your monthly tax contribution. The figure in item b18 should be the same as shown in your ea form. Notes for part f of form ea.

Part f is the most important part because it determines your taxable amount. Kat main page tu klik kat permohonan no pin. C failure to prepare and render form ea ec to employees on or before 29 february 2020 is an offence under paragraph 120 1 b of ita 1967. Balance of tax payable f1 f2.

Ok untuk sesiapa yang dah tahu ni cukai pendapatan die boleh la buat permohonan no pin kat ez hasil gov my ni. Section f of the ea or ec form displays arrears ofprevious years paid in the current year. Include those of your husband wife if you had chosen combined assessment in a5 and has declared his her income in c17. Only tax exempt allowances perquisites gifts benefits listed above no.

Aku pernah buat tahun lepas jadi aku dah tak payah buat tahun ni. Kad petrol elaun petrol atau elaun perjalanan atau kad tol atau gabungannya atas urusan rasmi. Status of tax for year of assessment 2011 this part has to be completed. Page 3 of e filing e be year assessment.

List of tax exempt allowances perquisites gifts benefits which are required to declare. Perkara had pengecualian setahun 1. Nota untuk bahagian f borang ea. Once you have logged in under the e filing section click on e borang and that will take you to your tax e filing form.

These arrears may include bonusfor previous years and or retroactive difference amount of the previousyears. Spouse does not have to fill in this section. Since there are only two lines in section f the reporting of theamounts is done as follows. Bawak je borang ea yg dah diberi oleh majikan.

If the ea or ec form is printed for year. Choose your corresponding income tax form e be and choose the assessment year tahun taksiran 2015. 1 to 8 are required to declare in part f of form ea.