Borang Form B Income Tax Malaysia

Program memfail borang nyata bn bagi tahun 2020.

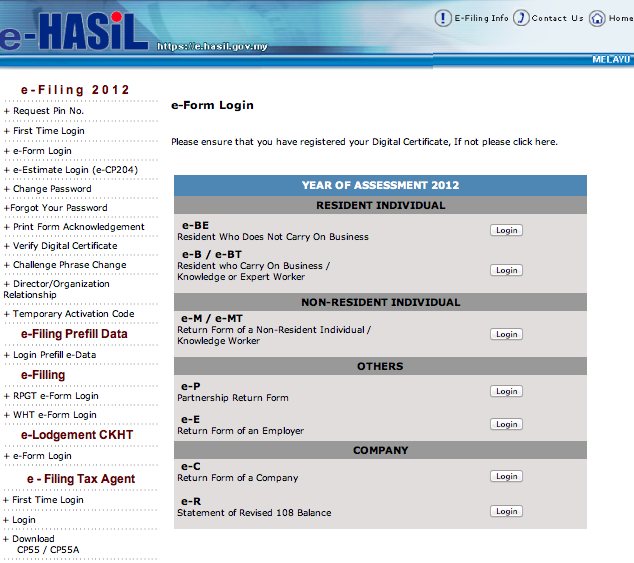

Borang form b income tax malaysia. To begin filing your tax click on e borang under e filing. Business income should be declared in the form b. Pembayar cukai dinasihatkan untuk menggunakan pengesahan penerimaan borang nyata cukai pendapatan sebagai pengesahan status seseorang yang dikenakan cukai di malaysia. Residents and non residents with non business income form be and m by 30 april continue reading borang tp 1 tax release form.

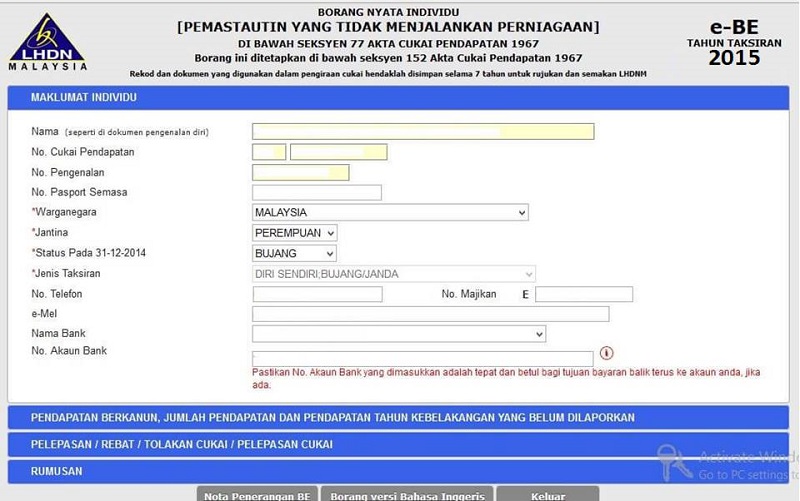

Under section 77 of the income tax act 1967 this form is prescribed under section 152 of the income tax act 1967 b 2016 form lembaga hasil dalam negeri malaysia cp4a pin. Residents and non residents with non business income form be and m by 30 april 2015. The due dates for submission are as follow. Income other than business.

Pay your income tax. Choose the right income tax form. 2016 1 year of assessment. Once you ve logged in you will be shown a list of features available on e filing.

If you have taxes due you can pay through various methods such as e banking collection agents and atm. The 2016 assessment year goes according to the calendar year meaning you will be filing your income tax return forms for 1 january 2016 to 31 december 2016. Here is a list of income tax forms and the income tax deadline 2019. Can i declare my business income if i receive a form be.

If you ve paid income tax in excess via monthly tax deductions the excess amount will be reimbursed to you via the bank account details you provided. Employers form e by 31 march 2017. The 2014 assessment year goes according to the calendar year meaning you will be filing your income tax return forms for 1 january 2014 to 31 december 2014. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020.

You can also pay your income tax via credit card. Pengesahan ini boleh didapati melalui perkhidmatan ezhasil di https ez hasil gov my atau di cawangan cawangan lhdnm. If you already have a tax file registered from previous employment do submit your return form even if your annual or monthly income falls below the chargeable level rm34 000 after epf deduction. Lembaga hasil dalam negeri malaysia year of assessment return form of an individual resident who does not carry on business under section 77 of the income tax act 1967 this form is precribed under section 152 of the income tax act 1967 be 2019 cp4b form amend.

However if you don t already have a tax file registered and your income is below the chargeable level you don t have to register a tax file.