How To Fill Borang E 2018

Choose your corresponding income tax form e be and choose the assessment year tahun taksiran 2015.

How to fill borang e 2018. The sections cited are also different. So what if you fail to submit borang e. In borang 1 2 the correct section to be cited are s 10 s 15 while in borang 3 4 5 the correct section to be cited are s 36 2 a b. A minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e to irb as well as prepare and deliver form ea to the employees.

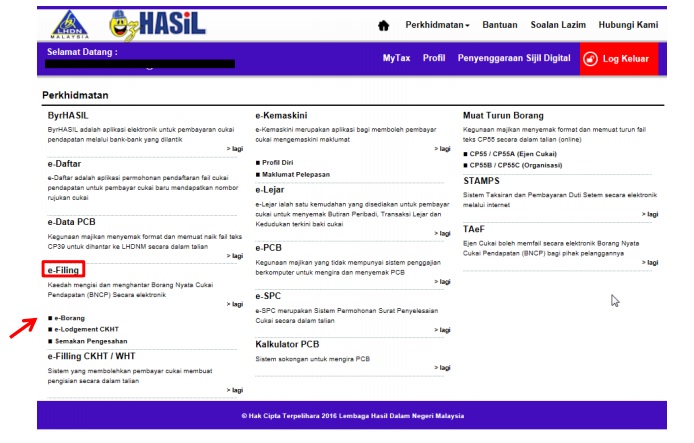

For many it is a time of extra stress and anxiety especially for the first time. After clicking on e borang then you will be shown a list of income tax forms. All companies sdn bhd must submit online for 2018 form e and onwards. Pada bahagian e be klik pada butang tahun taksiran dan pilih tahun yang ingin anda laporkan.

Be aware of dateline submission for borang e ea. Pada paparan utama pilih pautan e borang yang terletak dibawah bahagian e filing. Berikut merupakan contoh paparan bahagian maklumat individu. Be aware of penalties for late submission.

Failure to do so will result in the irb taking legal action against the company s director. Income tax declaration and submission. To walk through all the documents that needed to be prepared by business owners. Company owners employees who responsible to complete and submit borang e ea.

What if you fail to submit borang e and cp8d. Paparan berikut akan muncul. Nama 5 7 negeri no. In borang 3 4 5 your master is the applicant pemohon as opposed to borang 1 2 which you are the petitioner pempetisyen.

To educate business owners on how to fill up borang e ea. Once you have logged in under the e filing section click on e borang and that will take you to your tax e filing form. It s that time of the year again. Ini akan membawa anda ke bahagian yang seterusnya iaitu bahagian.

1 bersama bora 2018 cp8 pin. Remember you file for 2018 income tax in 2019. Failure in submitting borang e will result in the irb taking legal action against the company s directors. 2018 borang saraan bag i tahun e lembaga hasil dalam negeri malaysia penyata oleh majikan cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 tarikh terima 1 tarikh terima 2 untuk kegunaan pejabat e.

If you are an individual with non business income choose income tax form be e be and choose the assessment year tahun taksiran 2018.