How To Submit Borang E 2018 Online

Employer s responsibilities if you have an employee during last year it is mandatory to submit form e borang e to lhdn inland revenue board irb by upcoming 31 march.

How to submit borang e 2018 online. Failure in submitting borang e will result in the irb taking legal action against the company s directors. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. A minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e to irb as well as prepare and deliver form ea to the employees. 2018 borang saraan bag i tahun e lembaga hasil dalam negeri malaysia penyata oleh majikan cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 tarikh terima 1 tarikh terima 2 untuk kegunaan pejabat e.

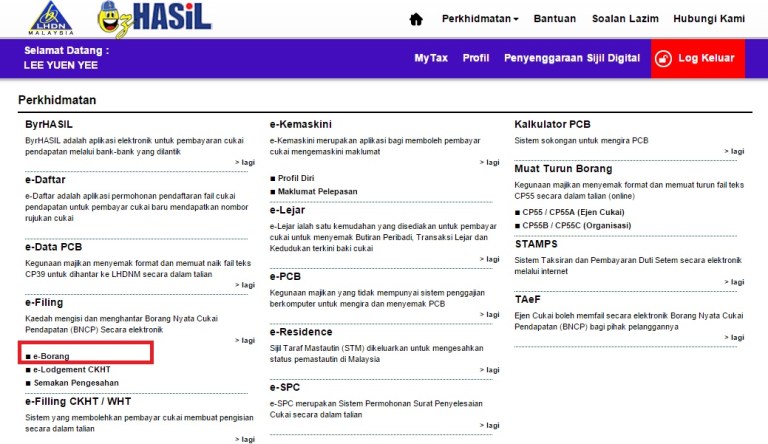

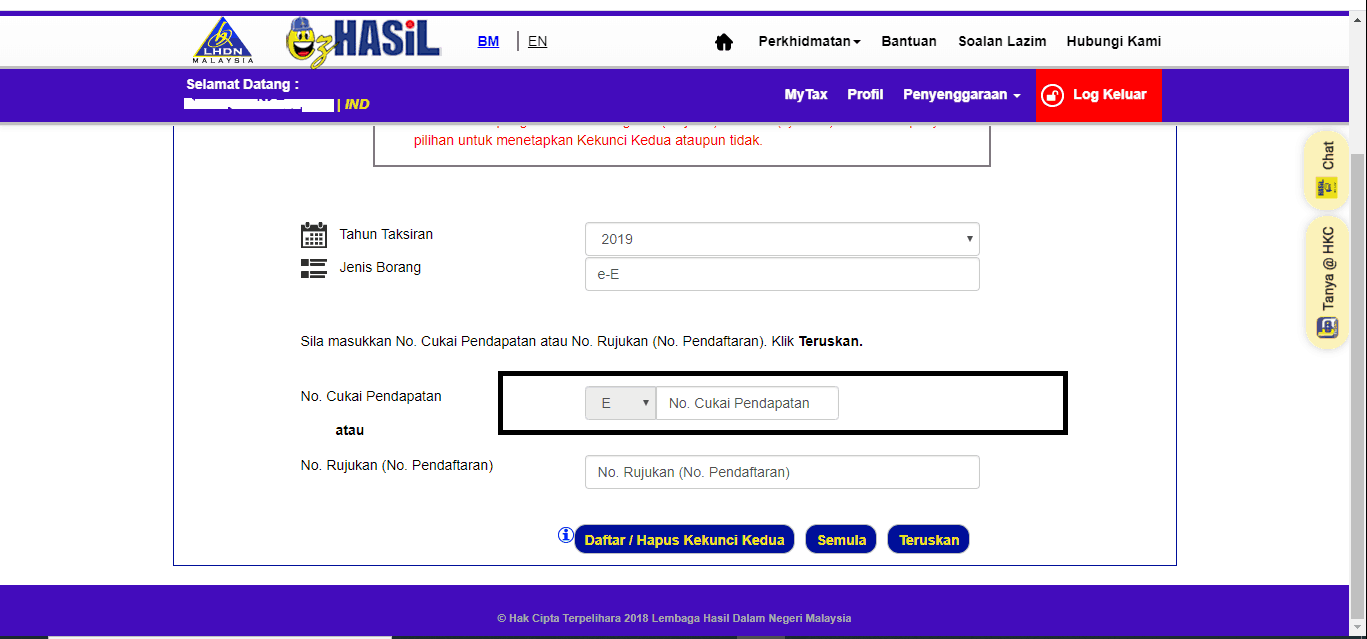

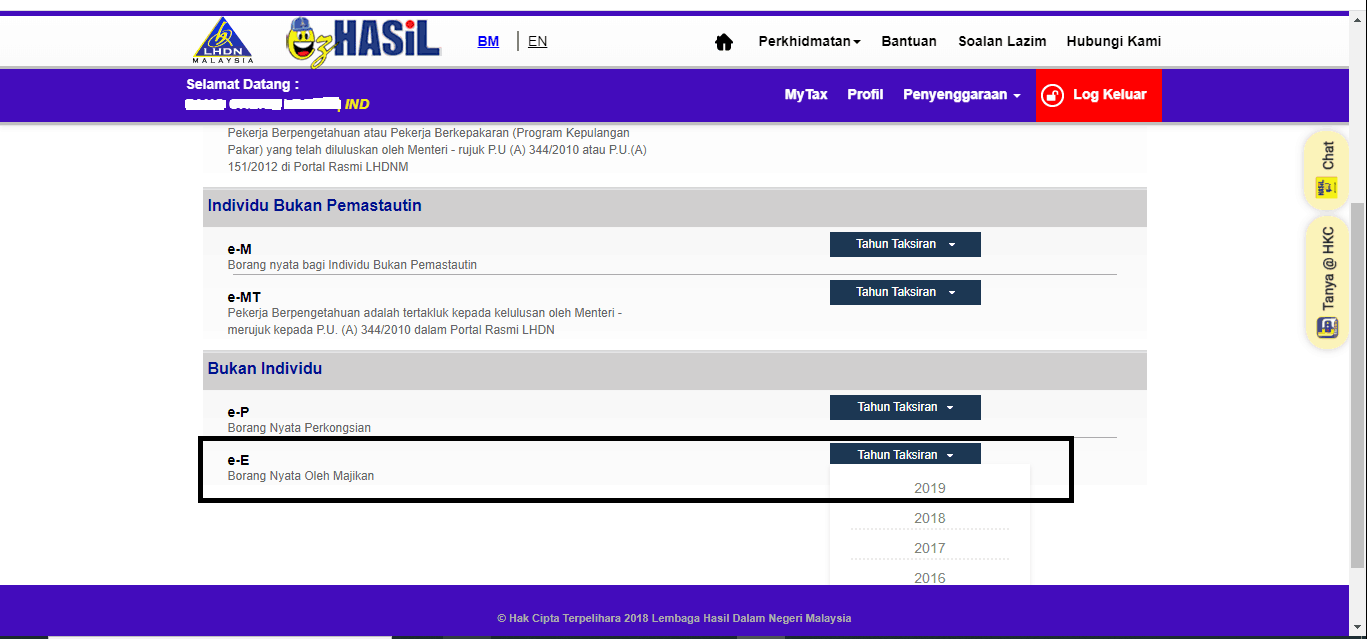

What if you fail to submit borang e and cp8d. Borang e bagi majikan bukan syarikat mulai tahun saraan 2018. Once you have logged in under the e filing section click on e borang and that will take you to your tax e filing form. 1 bersama bora 2018 cp8 pin.

Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year. Nama 5 7 negeri no. Borang nyata lembaga hasil dalam negeri malaysia lhdnm ingin memaklumkan bahawa tiada lagi pencetakan dan pengeposan borang nyata bn berikut. Borang be b m p tp tj dan tf mulai tahun taksiran 2018.

Choose your corresponding income tax form e be and choose the assessment year tahun taksiran 2015. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019. ð borang e yang diterima itu perlu dilengkapkan dan ditandatangani. All companies sdn bhd must submit online for 2018 form e and onwards.

Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. ð isikan 0 di bahagian a dan bahagian b borang e 2010. It is time to start preparing the form e return form of employer remuneration for the last calendar year. Failure to do so will result in the irb taking legal action against the company s director.

Pembayar cukai yang baru atau pertama kali melaporkan pendapatan menyamai melebihi rm 450 000 dimaklumkan bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac. Dear reader reminder for prepare form e.