How To Submit Borang Ea Online

Once you have logged in under the e filing section click on e borang and that will take you to your tax e filing form.

How to submit borang ea online. An online estimate tax payable form submission for company co operative society trust body. Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year. To walk through all the documents that needed to be prepared by business owners. Inland revenue board of malaysia irb charges 10 increment on the tax payable for late filing and additional 5 on the balance if the payment is not made after 60 days from the final date.

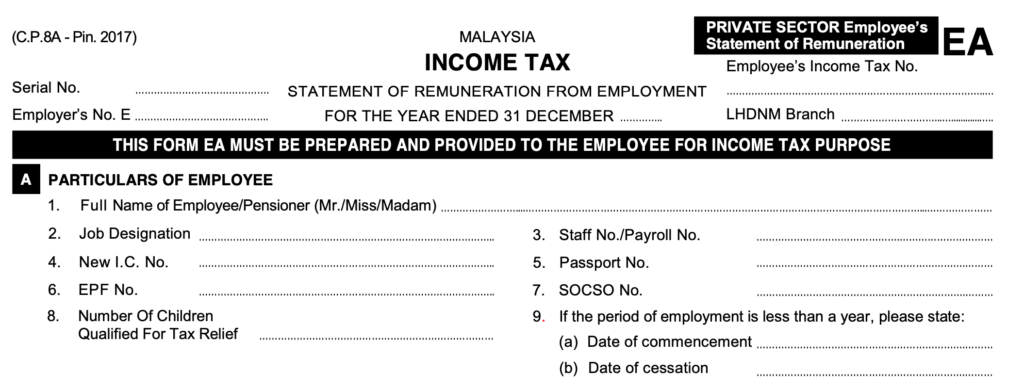

Ea form borang c p 8a overview in accordance with subsection 83 1a of the income tax act 1967 ita 1967 the form c p 8a c p 8c must be prepared and rendered to the employees on or before end of february the following year to enable them to complete and submit their respective return form within the stipulated period. What if you fail to submit borang e and cp8d. Nota untuk bahagian f borang ea. Step 1 and 2 are a must if you are a first time user.

Borang c p 8a ea format pdf borang c p 8a ea format excel borang ini boleh dimuat turun dan diguna pakai dalam format pdf dan excel nota panduan borang ea ec. Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. Be aware of dateline submission for borang e ea. How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967.

Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Be aware of penalties for late submission. Below are the steps needed for you to start using e filing to submit your income tax return form online. On and before 30 4 2020.

Failure to do so will result in the irb taking legal action against the company s director. C kegagalan menyedia dan menyerahkan borang ea ec kepada pekerja pada atau sebelum 28 februari 2019 adalah menjadi satu kesalahan di bawah perenggan 120 1 b acp 1967. B isi semua ruangan yang berkaitan dengan huruf besar dan gunakan pen mata bulat berdakwat hitam. To educate business owners on how to fill up borang e ea.

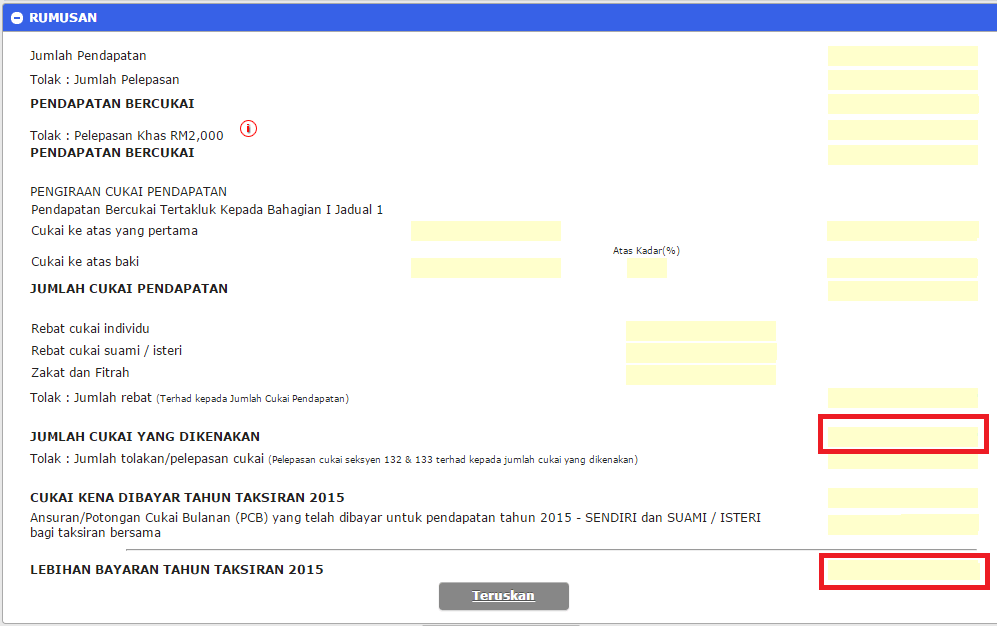

If you fail to submit a tax return and upon conviction you ll be liable to a fine of rm200 to as high as rm20 000 or six months of imprisonment. Choose your corresponding income tax form e be and choose the assessment year tahun taksiran 2015.