Borang B Sole Proprietor

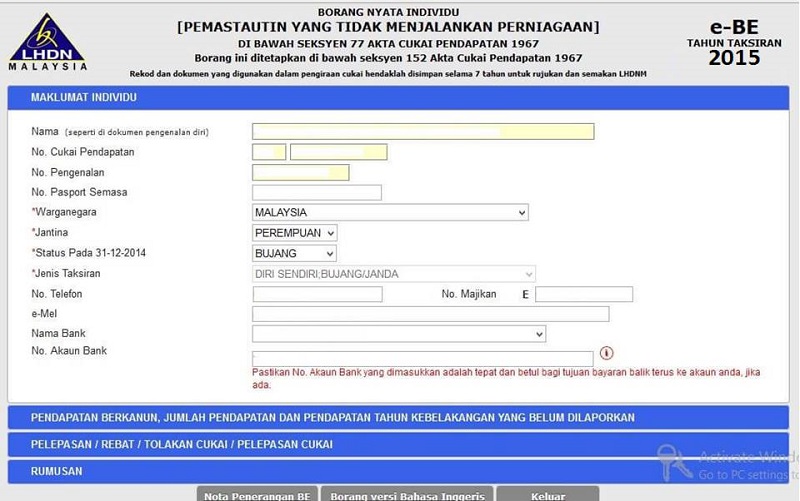

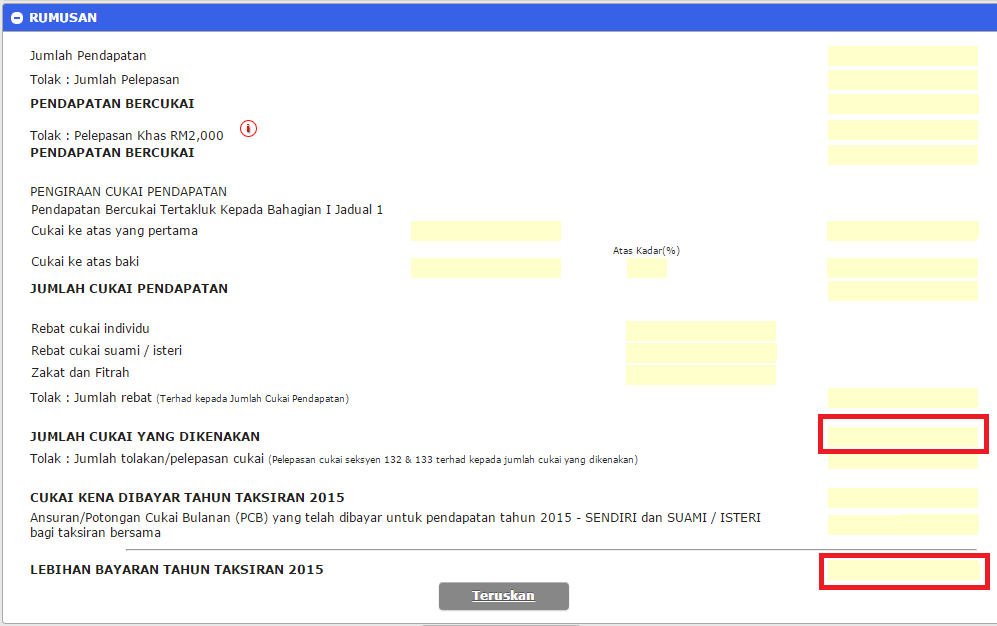

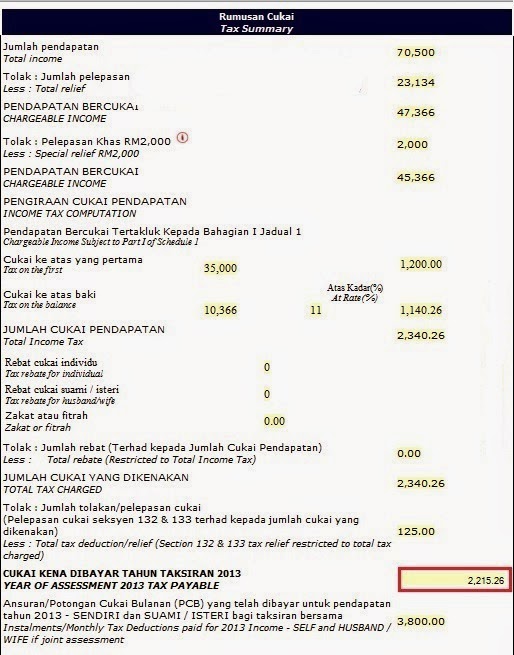

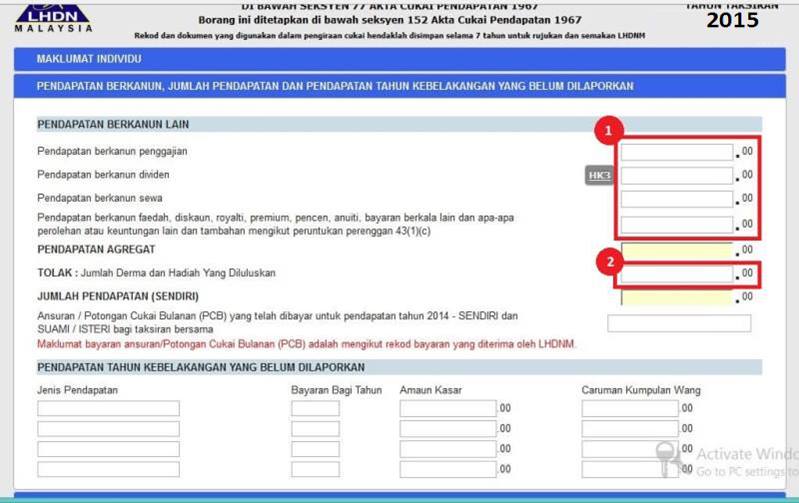

For your personal income tax remember that you still need to submit form e be online.

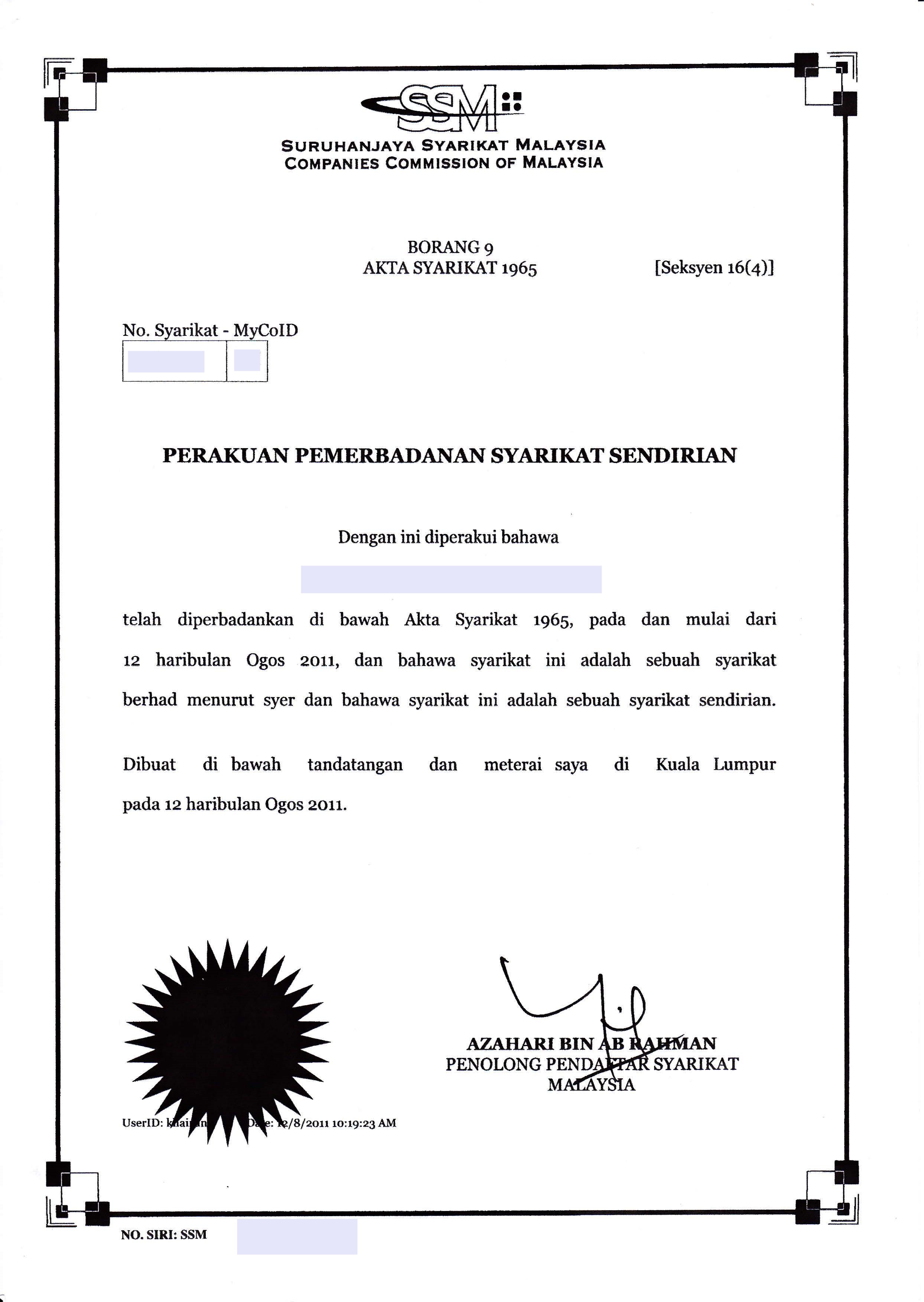

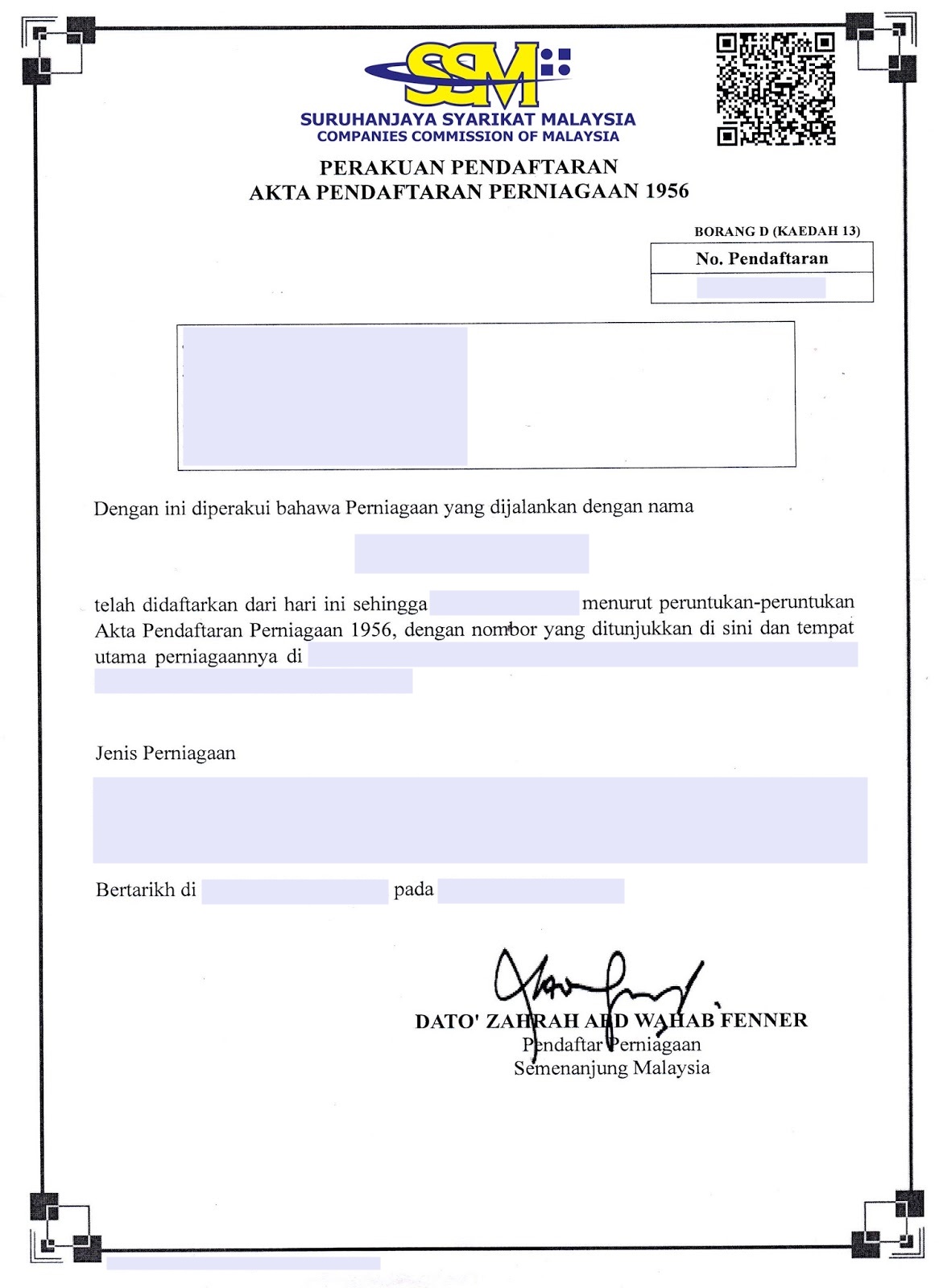

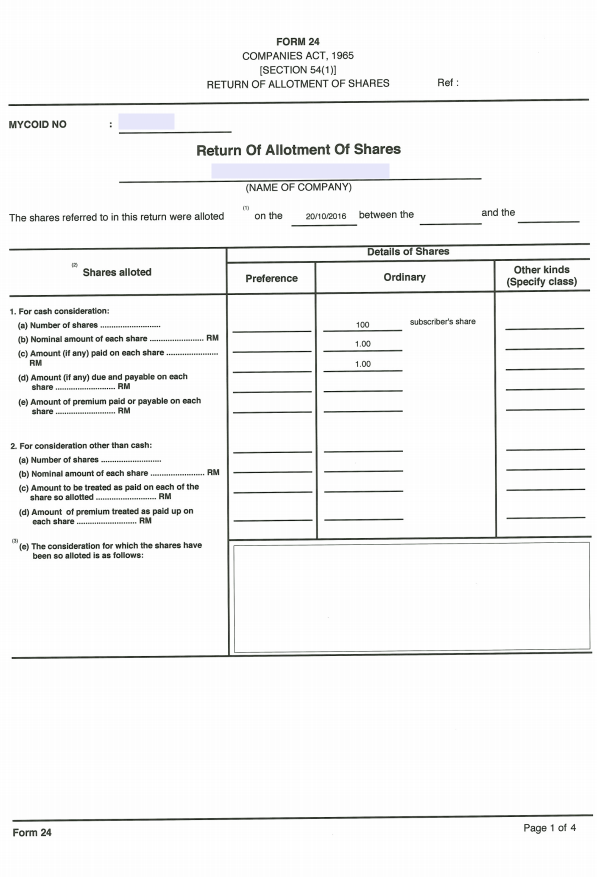

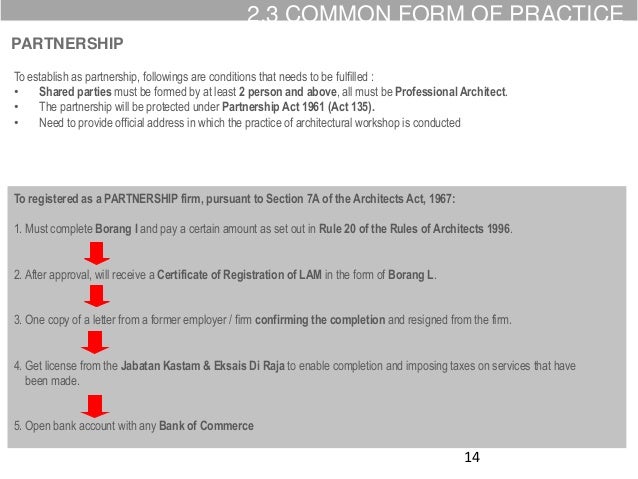

Borang b sole proprietor. Certified true copies. Failure to submit is an offence under section 120 1 b of ita 1967. Guideline for piam registration a new applicants sole proprietor partnership limited co 1 piam application form duly signed x 2 borang 24 49 x 3 borang 9 13 change of name x 4 borang a b d x 5 photocopy i c of corporate nominee x 6 mii certificate of corporate nominee x 7 piam fee cash or cheque x 8 statutory declaration by corporate nominee x. Sole proprietor vs llp vs general partnership vs company in malaysia types of business entities.

Can i declare my business income if i receive a form be. Business income should be declared in the form b. Business wholly owned by a single individual using personal name as per his her identity card or trade name. Sole proprietor pemilikan tunggal.

All partnership and sole proprietorship are mandatory to submit form e borang e as well. How to start a business. Association club society other religious bodies persatuan kelab pertubuhan badan badan agama yang lain. Partnership perkongsian liabiliti terhad llp company sdn bhd berhad syarikat sdn bhd berhad partnership perkongsian.

The following are the common forms of business organization in malaysia by an individual operating as sole proprietor. Please do not submit the following for llps. Form b that s for if you re a sole proprietor or form p that s for a partner in a conventional partnership. Remember llps are separate entities from their partners.

What will happen when you fail to submit form e. So they file tax separately. By two or more persons in limited liability partnership or. Form b income assessed under section 4 a 4 f of the ita 1967 and be completed by individual residents who have business income sole proprietorship or partnership.