How To Submit Borang E 2018

Employer s responsibilities if you have an employee during last year it is mandatory to submit form e borang e to lhdn inland revenue board irb by upcoming 31 march.

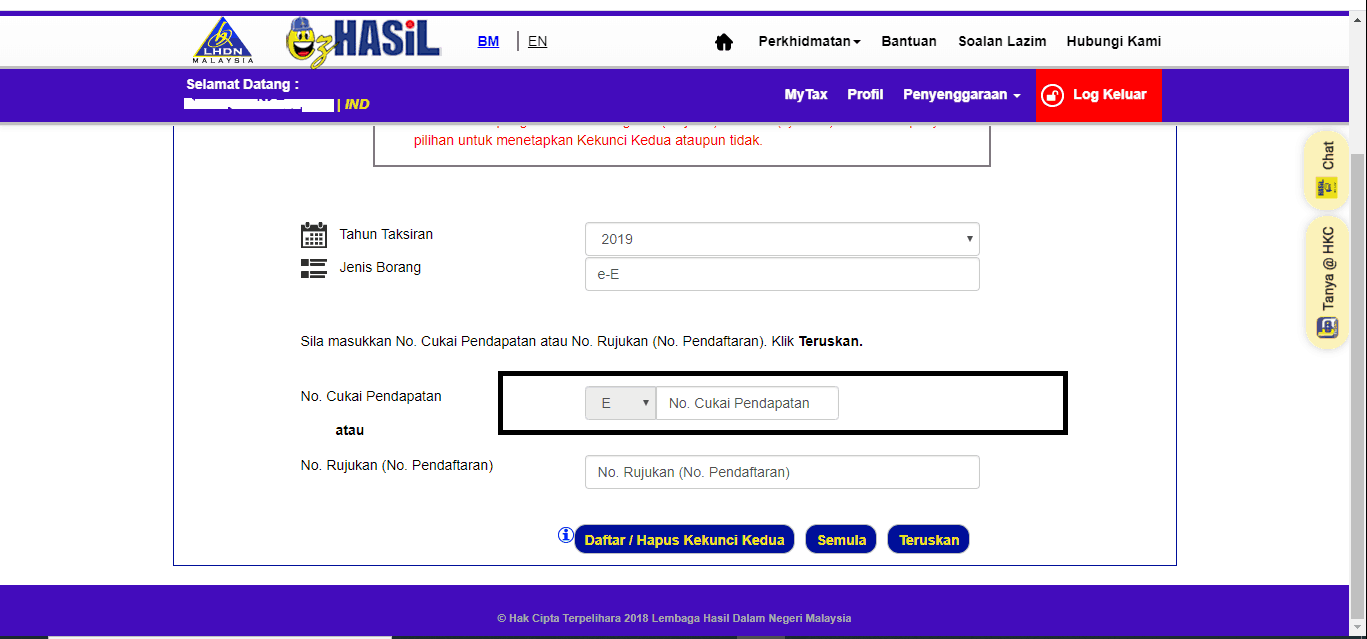

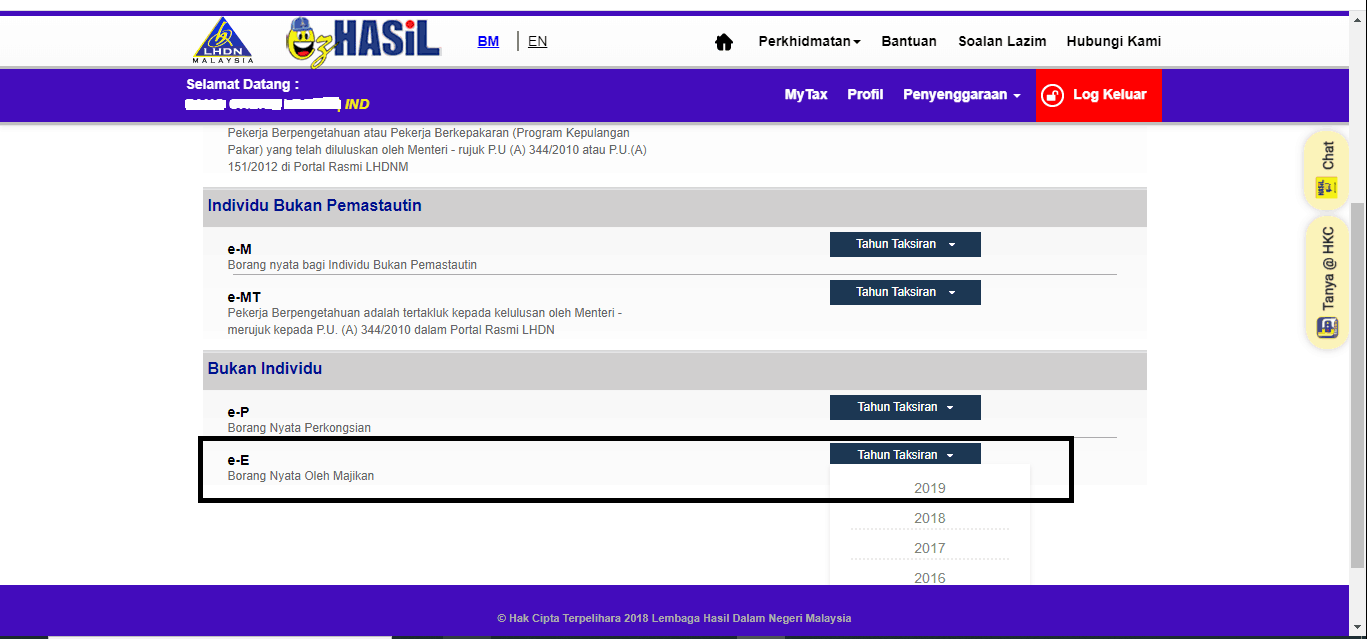

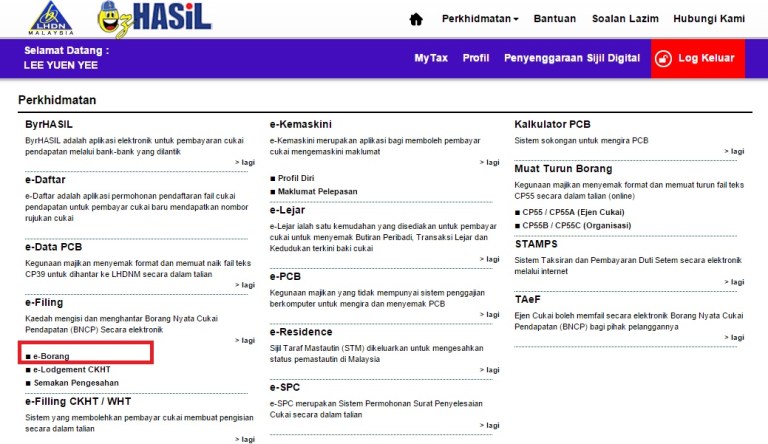

How to submit borang e 2018. Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. Bncp akan dianggap berjaya dihantar apabila paparan pengesahan penerimaan e borang bagi tahun taksiran berkenaan dipaparkan. Failure in submitting borang e will result in the irb taking legal action against the company s directors. Once you have logged in under the e filing section click on e borang and that will take you to your tax e filing form.

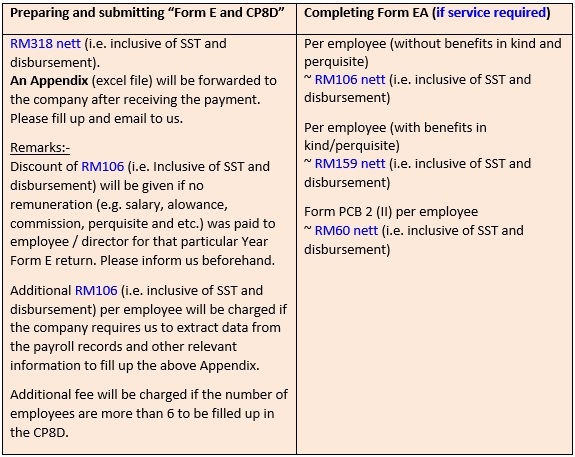

So what if you fail to submit borang e. 2018 borang saraan bag i tahun e lembaga hasil dalam negeri malaysia penyata oleh majikan cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 tarikh terima 1 tarikh terima 2 untuk kegunaan pejabat e. Dear reader reminder for prepare form e. Bagaimanakah saya ingin mengetahui bncp yang dihantar secara e filing telah berjaya dikemukakan.

Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. All companies sdn bhd must submit online for 2018 form e and onwards. It is time to start preparing the form e return form of employer remuneration for the last calendar year. Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year.

Taxpayers and employers which are companies are compulsorily required to submit form c and form e via e filing. Nama 5 7 negeri no. A minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e to irb as well as prepare and deliver form ea to the employees. 1 bersama bora 2018 cp8 pin.

Taxpayers may visit any nearest lhdnm branch for assistance in completing the income tax return form or call the hasil care line at the hotline 03 89111000 603 89111100 overseas for further explanation. What if you fail to submit borang e and cp8d. Failure to do so will result in the irb taking legal action against the company s director. Choose your corresponding income tax form e be and choose the assessment year tahun taksiran 2015.

Selepas menghantar borang cukai pendapatan saya menyedari bahawa pendapatan yang dilaporkan adalah tidak tepat.