Borang B Tax Rate

For code d0 always multiply the whole pay by 0 40 40 to find the tax deduction at the higher rate.

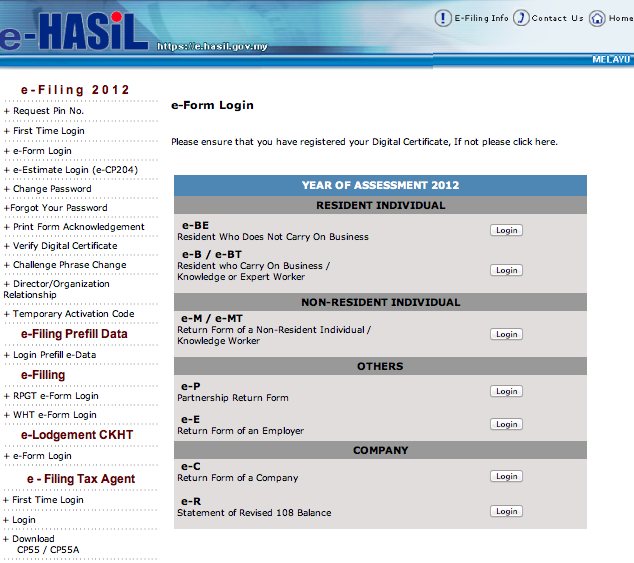

Borang b tax rate. Isnin hingga jumaat 9 00 am hingga 4 30 pm borang maklumbalas pelanggan. Tax administration diagnostic assessment tool tadat. 1 how to declare the technical fee received from llp into my personal income tax borang e b. How to use a tax code for code br always multiply the whole pay by 0 20 20 to find the tax deduction at the basic rate.

03 8911 1000 603 8911 1100 luar negara waktu operasi. Malaysia income tax e filing. Helaian kerja berkaitan dengan pembayaran balik hk 6 hk 8 hk 9. Band taxable income tax rate.

What is income tax return. Anda hanya perlu mengisi borang b sahaja jika anda mempunyai pendapatan perniagaan dan juga anda perlu mengembalikan borang b selewat lewatnya pada 30 jun. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Sila isikan pendapatan penggajian anda dalam borang b yang sama.

For code d1 always multiply the whole pay by 0 45 45 to find the tax deduction at the additional rate. Program memfail borang nyata bn bagi tahun 2020. Pendapatan perniagaan penggajian dan pendapatan lain. 2 for profit sharing after deducted 18 llp income tax which i have received from my llp i understand that it is tax free for this amount since it has been tax 18 how and where shall i report this amount in my borang b.

5 000 pertama 15 000 berikutnya. What is tax rebate. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. 1 4479 homestead tax rate 2 3542 non residential tax rate.

Nota penerangan b 2018 slip pengiriman bayaran cp501. How does monthly tax deduction mtd pcb work in malaysia. Adakah saya perlu mengisi kedua dua borang b dan be. Nota panduan borang nyata terpinda b 2018.

Municipal tax rate 0 9063 education rate. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020. Pengiraan rm kadar cukai rm 0 5 000.