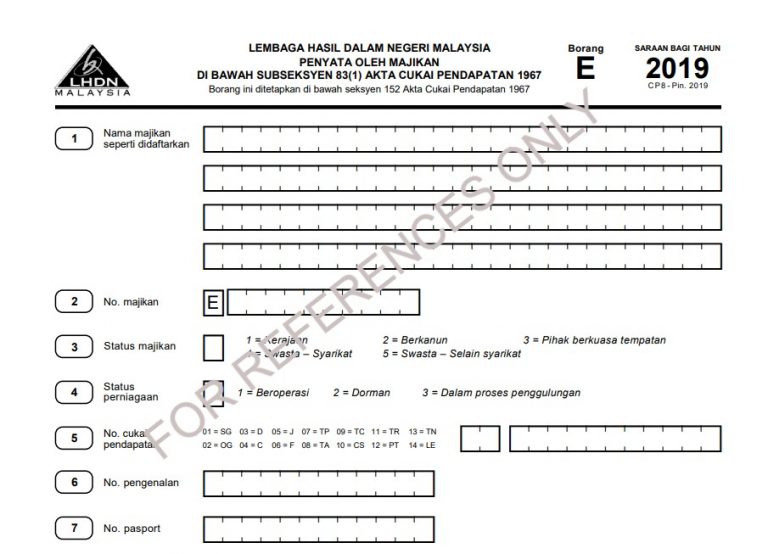

Borang E Online Submission

Failure in submitting borang e will result in the irb taking legal action against the company s directors.

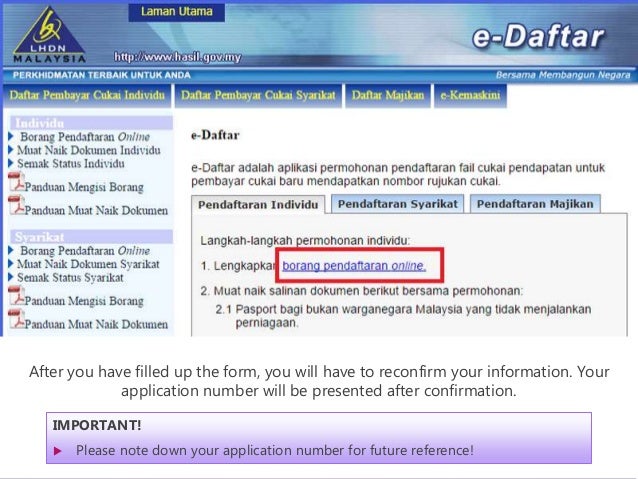

Borang e online submission. Pembayar cukai yang baru atau pertama kali melaporkan pendapatan menyamai melebihi rm 450 000 dimaklumkan bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac. So what if you fail to submit borang e. A minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e to irb as well as prepare and deliver form ea to the employees. E permohonan pindaan be adalah permohonan pindaan atas kesilapan atau khilaf bagi borang nyata cukai pendapatan yang telah dikemukakan secara e filing atau m filing dalam tempoh semakan pengesahan semakan semula pengesahan penerimaan borang yang telah dihantar secara e filing.

Be sure to print a draft copy for safe keeping by clicking. Upon filling up the required details the final step would be to sign off and send by selecting the tandatangan hantar button. Online submission via lhdn portal. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees.

What if you fail to submit borang e and cp8d.