Borang E Submission Date

According to the income tax act 1967 akta 53.

Borang e submission date. I submission of a complete and acceptable form e a form e shall only be considered complete if c p 8d is furnished on or before the due date for submission of the form. B form e and c p 8d must be submitted in accordance with the format as provided by lhdnm. Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30. Form e and c p 8d which do not comply with the format as stipulated.

Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Form e will only be considered complete if c p. 10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019.

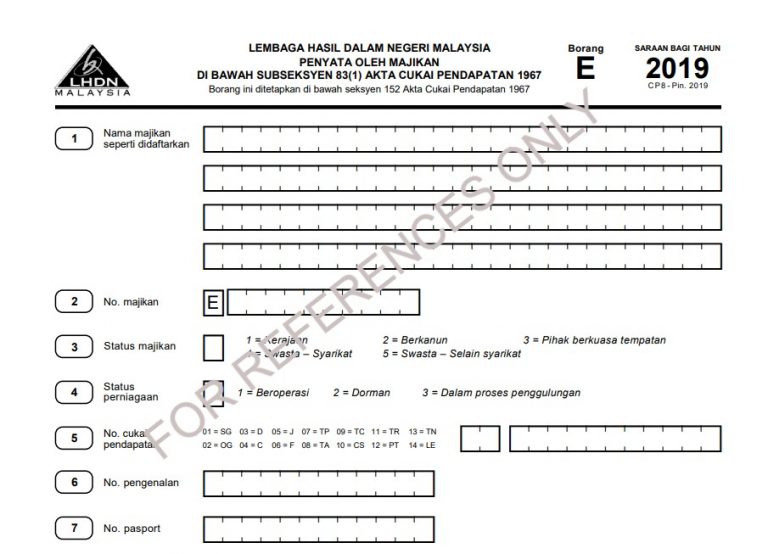

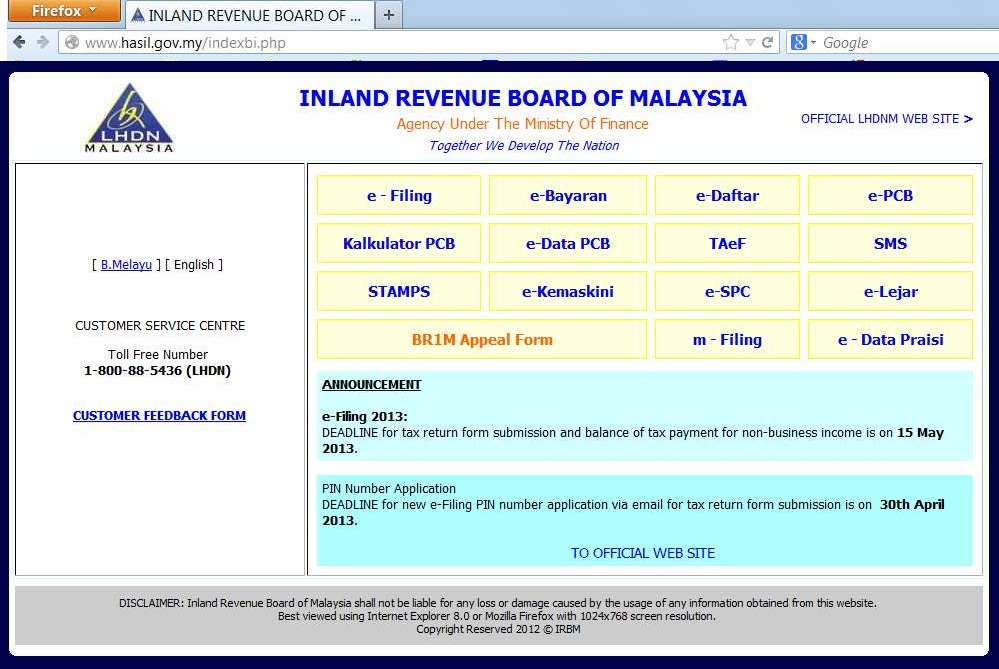

Borang e is an employer s annual return of remuneration for every calendar year and due for submission by 31st march of the following calendar year. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. You can file your taxes on ezhasil on the lhdn website. Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing.

Failure to do so will result in the irb taking legal action against the company s director. 31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. Employers are encouraged to furnish the particulars online using edata praisi which can be accessed via the lhdnm official portal before or on 22 february 2017 the format for information layout for prefill can be obtained from the lhdnm official portal.

Schedule on submission of return forms form type category due date for submission e 2019 employer 31 march 2020 be 2019 resident individual who does not carry on any business 30 april 2020 b 2019 resident individual who carries on business 30 june 2020 p 2019 partnership bt 2019 resident individual knowledge worker expert worker. 8d is furnished before or on the due date for submission of the form.