Borang Ea Deadline

Borang cp204 cp204a dan cp204b.

Borang ea deadline. Program memfail borang nyata bn bagi tahun 2020. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. Mulai tahun taksiran 2018 syarikat hendaklah mengemukakan anggaran cukai secara elektronik kepada lembaga hasil dalam negeri malaysia. The internal revenue board lhdn has extended the deadline for income tax form submission until the end of june 2020.

The deadline for filing income tax return forms in malaysia has been extended by two months. This decision was made in conjunction with the restricted movement order rmo that is in place from today until 31 march 2020 due to covid 19 pandemic. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019. Antara senarai dokumen yang perlu ada.

How to file your personal income tax online in malaysia. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. What if you fail to submit borang e and cp8d. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020.

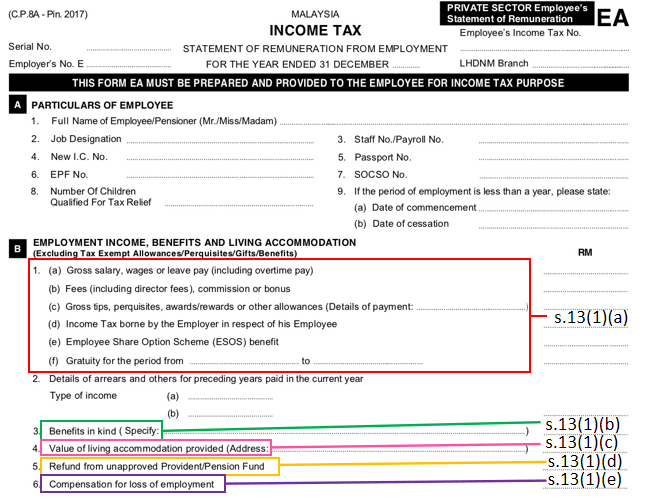

Nota panduan borang ea ec. Borang ea daripada majikan anda. Bukan selepas tarikh tutup 30 april. Tarikh kahwin cerai mati mana mana yang berkenaan.

Pembayaran balik untuk cukai yang terlebih bayar selalunya dibuat selepas 13 14 hari daripada tarikh anda menghantar borang. You can file your taxes on ezhasil on the lhdn website. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. Anggaran cukai yang kena dibayar oleh syarikat perkongsian liabiliti terhad koperasi badan amanah.

Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. Failure to do so will result in the irb taking legal action against the company s director. Ii form c p 8a c p 8c ea ec to be rendered to employees pursuant to the provision under subsection 83 1 a of ita 1967 employers are required to prepare form c p 8a c p 8c ea ec for the year ended 2018 and render the completed form to all their employees on or before 28 february 2019.