Submit Borang Ea

Unlike form e employers do not need to submit ea form to irb.

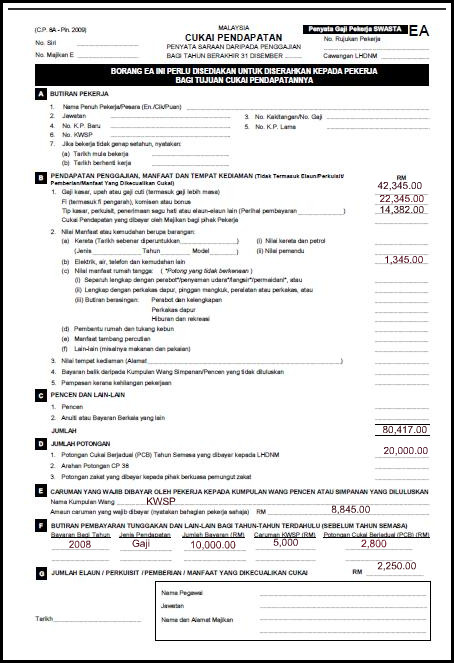

Submit borang ea. Therefore the information of employee s income on a form e must be consistent with the information stated on an employee s ea form. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year. Program memfail borang nyata bn bagi tahun 2020.

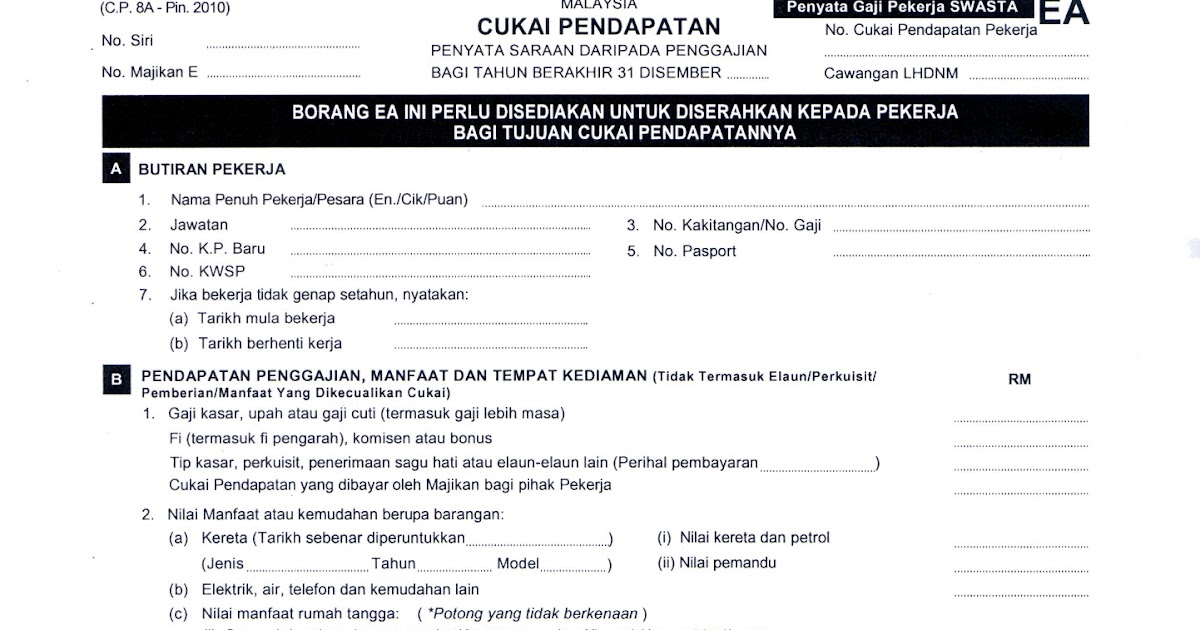

Failure to do so will result in the irb taking legal action against the company s director. Talenox offers a convenient way for companies in malaysia to import their employee data. Yearly remuneration statement ea ec form refer to section 83 1a income tax act 1967 with effect from year of assessment 2009 every employer shall for each year prepare and render to his employee statement of remuneration of that employee on or before the last day of february in the year immediately following the first mentioned year. What if you fail to submit borang e and cp8d.

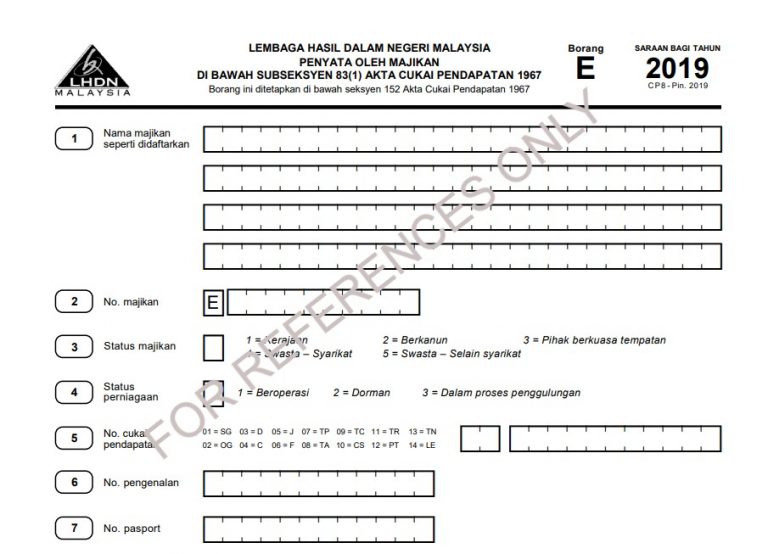

Borang cp204 cp204a dan cp204b. Form e field by the employer is in fact where the irb can do a cross check on whether an employee is reporting his income correctly. Mulai tahun taksiran 2018 syarikat hendaklah mengemukakan anggaran cukai secara elektronik kepada lembaga hasil dalam negeri malaysia. 8a borang e form e or c p.

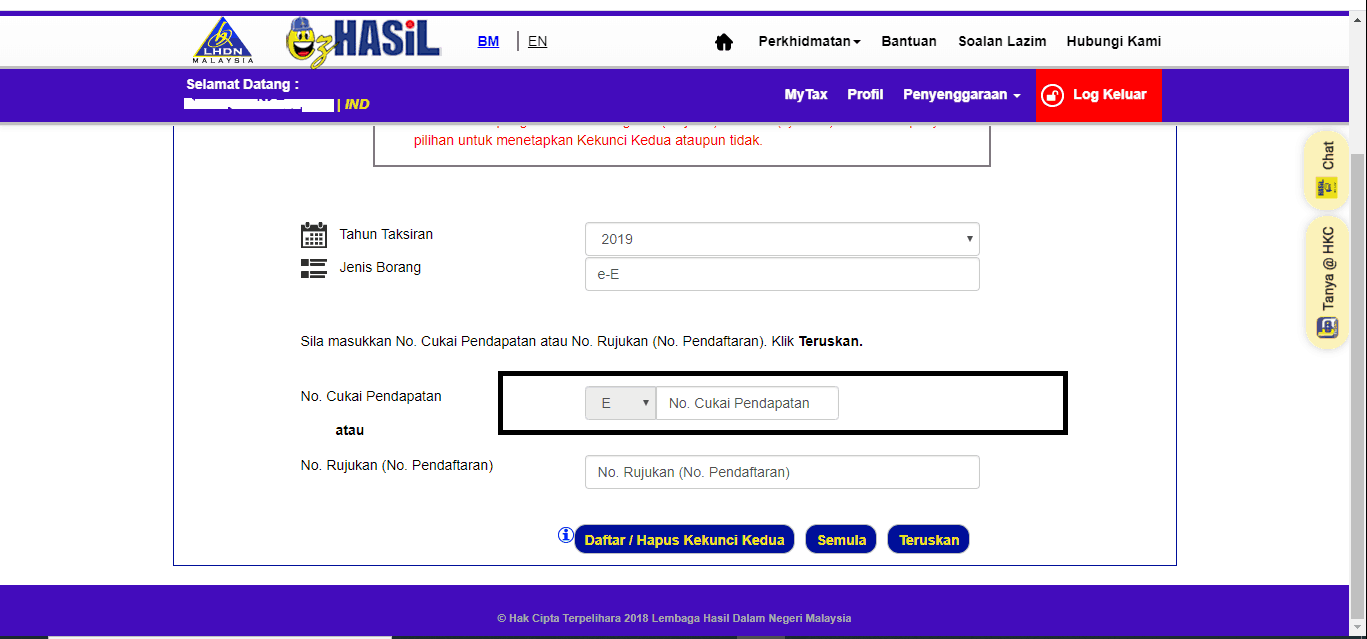

Nota panduan borang ea ec. Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967. To generate past years payroll record and tax forms such as borang ea form ea or c p.

On and before 30 4 2020. Ii form c p 8a c p 8c ea ec to be rendered to employees pursuant to the provision under subsection 83 1 a of ita 1967 employers are required to prepare form c p 8a c p 8c ea ec for the year ended 2018 and render the completed form to all their employees on or before 28 february 2019.